Working Capital Calculator & Cash Conversion Cycle Calculator: Optimize Your Business Cash Flow

Understanding and managing working capital is crucial for every business’s financial health. Our Working Capital Calculator and Cash Conversion Cycle (CCC) Calculator help you analyze how efficiently your business manages cash tied up in day-to-day operations.

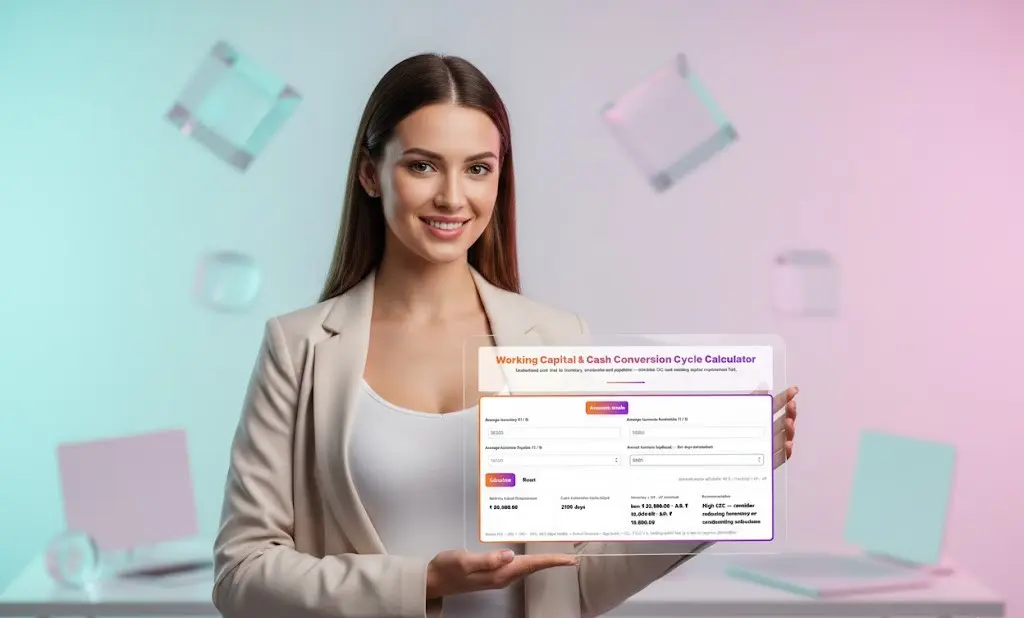

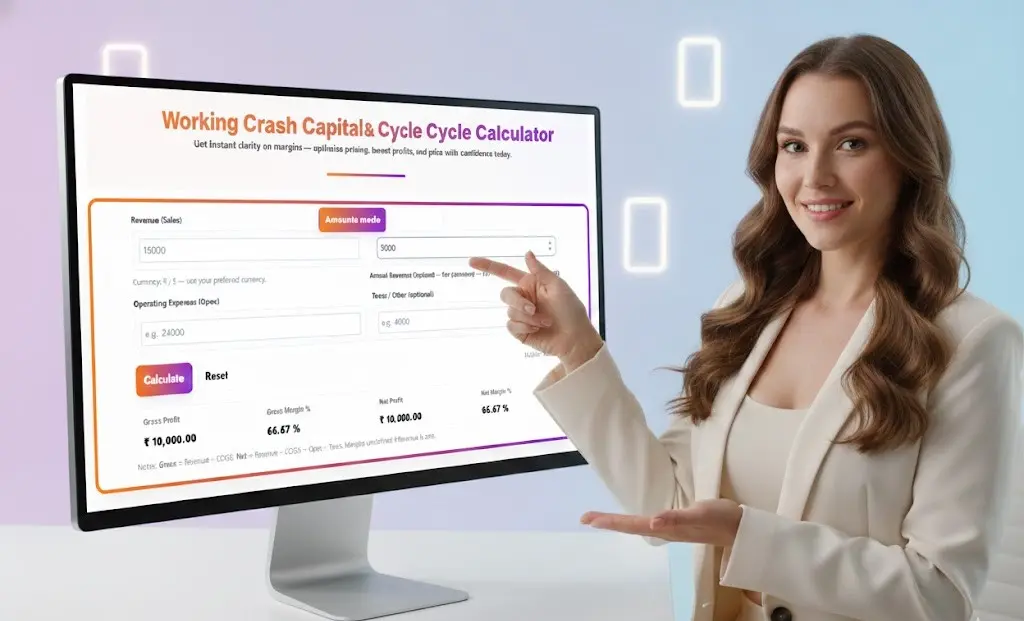

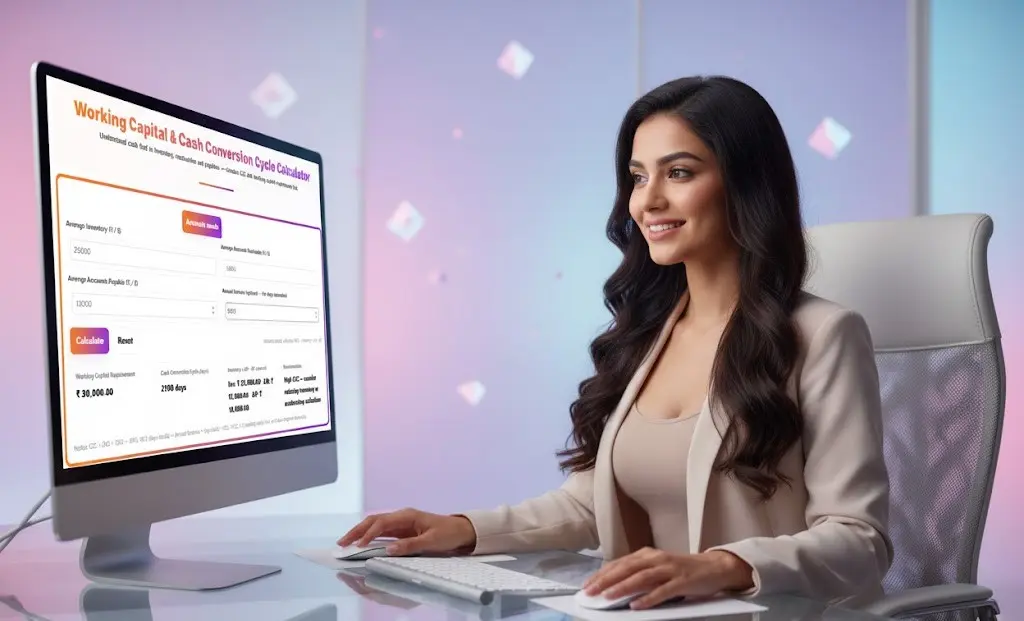

Working Capital & Cash Conversion Cycle Calculator

Understand cash tied in inventory, receivables and payables — calculate CCC and working capital requirement fast.

Working Capital Requirement

—

Cash Conversion Cycle (days)

—

Inventory + AR − AP (amount)

—

Recommendation

—

Notes: CCC = DIO + DSO − DPO. WCR (days mode) = (Annual Revenue ÷ days basis) × CCC. If CCC ≤ 0, working capital tied up is low or negative (favourable).

What is Working Capital?

Working capital represents the difference between a company’s current assets and current liabilities. It measures your business’s ability to meet short-term obligations and fund ongoing operations. Positive working capital indicates financial stability, while negative working capital may signal liquidity challenges.

Working Capital Formula:

Working Capital = Current Assets – Current Liabilities

Or more specifically: Working Capital = (Inventory + Accounts Receivable) – Accounts Payable

Understanding Cash Conversion Cycle (CCC)

The Cash Conversion Cycle (CCC) is a critical metric that measures how long it takes your business to convert investments in inventory and other resources back into cash. A shorter CCC means your business converts investments into cash more quickly, improving liquidity and reducing financing needs.

Cash Conversion Cycle Formula:

CCC = DIO + DSO – DPO

Where:

- DIO (Days Inventory Outstanding) = Time inventory sits before being sold

- DSO (Days Sales Outstanding) = Time to collect payment from customers

- DPO (Days Payables Outstanding) = Time taken to pay suppliers

How to Use This Working Capital Calculator

Our free working capital calculator simplifies complex financial calculations:

- Enter Average Inventory: Input your average inventory value in rupees or dollars

- Add Average Accounts Receivable: Enter the average amount customers owe you

- Input Average Accounts Payable: Add the average amount you owe suppliers

- Include Annual Revenue (optional): For precise days conversion calculations

- Click Calculate: Get instant results for working capital requirements and CCC

Key Benefits of Calculating Working Capital & CCC

For Business Owners:

- Improve Cash Flow Management: Identify how much cash is locked in operations

- Optimize Inventory Levels: Reduce excess inventory that ties up capital

- Accelerate Collections: Understand receivables impact on cash availability

- Strategic Payment Planning: Balance supplier payments with cash flow needs

For Financial Managers:

- Working Capital Optimization: Benchmark against industry standards

- Financial Planning: Forecast cash requirements accurately

- Performance Monitoring: Track efficiency improvements over time

- Investment Decisions: Determine optimal capital allocation

Interpreting Your Results

Working Capital Requirement

The calculator displays your total working capital requirement—the amount of capital needed to fund daily operations. Higher requirements indicate more cash tied up in the business cycle.

Cash Conversion Cycle (Days)

- Negative CCC: Excellent! You collect from customers before paying suppliers

- 0-30 Days: Strong cash management

- 31-60 Days: Average performance, room for improvement

- 60+ Days: High CCC—consider strategies to reduce inventory, accelerate collections, or extend payables

Actionable Recommendations

Based on your CCC, you’ll receive specific recommendations:

- Reduce Inventory: Implement just-in-time inventory management

- Accelerate Collections: Offer early payment discounts, tighten credit terms

- Optimize Payables: Negotiate extended payment terms with suppliers

Working Capital Management Strategies

1. Inventory Optimization

- Reduce Days Inventory Outstanding (DIO) through demand forecasting

- Implement inventory management systems

- Eliminate slow-moving or obsolete stock

2. Accounts Receivable Management

- Shorten Days Sales Outstanding (DSO) with clear credit policies

- Offer incentives for early payment

- Use automated invoicing and payment reminders

3. Accounts Payable Optimization

- Extend Days Payables Outstanding (DPO) without damaging supplier relationships

- Negotiate better payment terms

- Take advantage of early payment discounts when beneficial

Why Cash Conversion Cycle Matters

The CCC metric directly impacts:

- Liquidity: How quickly you can access cash

- Profitability: Reduced financing costs improve margins

- Growth Capacity: Efficient working capital frees resources for expansion

- Creditworthiness: Strong CCC improves lending terms

Industry Benchmarks for Working Capital

Working capital requirements vary by industry:

- Retail: 15-30 days CCC typical

- Manufacturing: 60-90 days due to production cycles

- Services: Often negative CCC (receive payment before delivery)

- E-commerce: 20-40 days depending on inventory model

Advanced Working Capital Calculations

For comprehensive financial analysis, consider:

- Working Capital Ratio: Current Assets ÷ Current Liabilities

- Net Working Capital: Total current assets minus total current liabilities

- Operating Cycle: Time from purchasing inventory to collecting cash

- Cash Flow from Operations: Actual cash generated from business activities

Common Working Capital Challenges

Many businesses face these obstacles:

- Excessive Inventory: Overstocking ties up valuable capital

- Slow Collections: Extended payment terms strain cash flow

- Early Supplier Payments: Paying too quickly reduces available cash

- Seasonal Fluctuations: Revenue variations complicate planning

- Growth Funding: Rapid expansion increases working capital needs

Best Practices for Working Capital Efficiency

- Monitor Regularly: Calculate CCC monthly or quarterly

- Set Targets: Establish CCC reduction goals

- Automate Processes: Use technology for invoicing and inventory management

- Negotiate Terms: Improve both receivable and payable conditions

- Forecast Accurately: Anticipate seasonal working capital requirements

Using Calculator Results for Financial Planning

The insights from this working capital calculator enable:

- Budget Preparation: Allocate sufficient capital for operations

- Loan Applications: Demonstrate working capital needs to lenders

- Investor Presentations: Show efficient capital management

- Strategic Planning: Make informed decisions about growth initiatives

Conclusion

Effective working capital management is essential for business sustainability and growth. Our Cash Conversion Cycle Calculator provides the insights needed to optimize your business’s cash flow, reduce financing costs, and improve overall financial performance.

Calculate your working capital requirements today and take the first step toward better financial management!

Frequently Asked Questions (FAQ)

Q1: What is a good Cash Conversion Cycle (CCC)?

A: A good CCC varies by industry, but generally, a lower number is better. Negative CCC (0 or below) is excellent, meaning you collect from customers before paying suppliers. For most businesses, 30-60 days is considered efficient, while anything over 90 days may indicate cash flow inefficiencies that need addressing.

Q2: How do I calculate working capital requirement?

A: Working capital requirement is calculated as: (Average Inventory + Average Accounts Receivable) – Average Accounts Payable. This formula shows how much capital is needed to fund your business’s day-to-day operations. Simply input these three values in our calculator to get your working capital requirement instantly.

Q3: What’s the difference between working capital and cash conversion cycle?

A: Working capital is the dollar amount of capital tied up in operations (Inventory + Receivables – Payables), while Cash Conversion Cycle measures the time (in days) it takes to convert that invested capital back into cash. CCC helps you understand efficiency, while working capital shows the absolute funding requirement.

Q4: How can I reduce my Cash Conversion Cycle?

A: You can reduce CCC through three strategies: (1) Decrease Days Inventory Outstanding by reducing inventory levels and improving turnover, (2) Decrease Days Sales Outstanding by collecting from customers faster through better credit terms or incentives, and (3) Increase Days Payables Outstanding by negotiating extended payment terms with suppliers without damaging relationships.

Q5: Why is my working capital requirement so high?

A: High working capital requirements typically result from: excessive inventory levels, slow-paying customers (high receivables), or paying suppliers too quickly (low payables). High CCC indicates inefficiency—review each component to identify where cash is being tied up and implement targeted improvement strategies.

Q6: What does negative working capital mean?

A: Negative working capital means your current liabilities exceed current assets—you owe more short-term than you have available. While this can be concerning, some businesses (like retailers who collect cash immediately and pay suppliers later) successfully operate with negative working capital. Context matters based on your business model.

Q7: How often should I calculate my working capital and CCC?

A: Calculate working capital and CCC at least monthly for active cash flow management, and quarterly for strategic planning. Businesses with volatile sales or inventory should monitor weekly. Regular tracking helps identify trends, measure improvement initiatives, and make timely adjustments to working capital strategies.

Q8: Can I use this calculator for any currency?

A: Yes! Our working capital calculator works with any currency—simply input your amounts in rupees (₹), dollars ($), euros (€), or any other currency. The calculator performs the same mathematical operations regardless of currency, providing accurate working capital requirements and CCC days for your business.

Q9: What’s considered a healthy working capital ratio?

A: A healthy working capital ratio (Current Assets ÷ Current Liabilities) typically ranges from 1.2 to 2.0. Below 1.0 indicates potential liquidity problems, while above 2.0 might suggest inefficient use of assets. However, optimal ratios vary by industry, business model, and growth stage.

Q10: How does annual revenue affect the CCC calculation?

A: Annual revenue is used to convert absolute amounts (inventory, receivables, payables) into days. The formula uses: CCC = (Inventory ÷ Daily Revenue) + (Receivables ÷ Daily Revenue) – (Payables ÷ Daily COGS). Providing annual revenue enables more accurate days-based metrics that are easier to benchmark and track over time.

Start optimizing your business cash flow today with our free Working Capital & Cash Conversion Cycle Calculator!

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Personal Loan EMI Calculator

- Home Loan EMi Calculator

- SIP Calculator

- SIP Goal Calculator

- CAGR Calculator

- XIRR Calculator

- SWP Calculator

- STP Calculator

- Free Lumpsum Investment Calculator: Maximize the Future Value

- CSV to JSON Converter

- QR Code Generator

- CSV to Excel Converter

- Base64 Encoder/Decoder

- Regex Tester

- JSON Formatter & Validator

- UUID Generator

- Strong Password Generator

- Lorem Ipsum Generator

- URL Encoder & Decoder

- HTML escape-unescaped tools

- JPG to PDF Converter

- PDF to JPG Converter

- PDF Compressor

- PDF Merge

- Case Converter

- Break-Even Calculator

- ROI Calculator

- Free Profit Margin Calculator – Calculate Profit Margins Instantly

- Startup Runway & Burn Rate Calculator – Calculate Cash Runway Free

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM