Vendor Payment Terms Calculator: Calculate Early Payment Discount APR

Managing vendor payments strategically can significantly impact your business’s cash flow and profitability. Our Vendor Payment Terms Calculator helps you evaluate the true annual cost of forgoing early payment discounts by calculating the implied Annual Percentage Rate (APR). Whether you’re deciding between 2/10 net 30 terms or comparing multiple vendor offers, this free calculator provides instant insights to help you make data-driven payment decisions. Simply enter your invoice amount, payment terms, and discount details to discover whether taking early payment discounts is a smart financial move or if preserving cash flow makes more sense for your business.

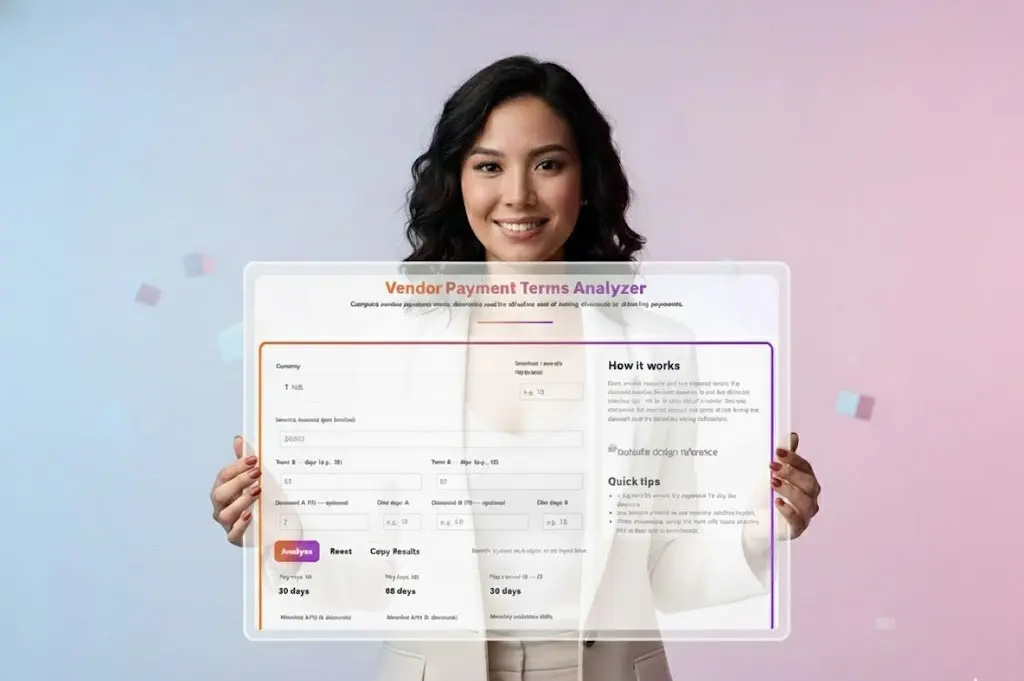

Vendor Payment Terms Analyzer

Compare vendor payment terms, discounts and the effective cost of taking discounts vs deferring payments.

Vendor Payment Terms Analyzer: Optimize Your Cash Flow & Payment Decisions

What is the Vendor Payment Terms Analyzer?

The Vendor Payment Terms Analyzer is a powerful financial calculator that helps businesses evaluate the true cost of early payment discounts versus deferred payment options. By calculating the Annual Percentage Rate (APR) of forgoing vendor discounts, this tool enables finance professionals, procurement teams, and business owners to make data-driven decisions about when to take advantage of early payment discounts and when to preserve cash flow.

How Does the Payment Terms Calculator Work?

Our payment terms analyzer simplifies complex financial calculations by evaluating two payment scenarios:

Term A represents the early payment option with a discount (e.g., 2% discount if paid within 10 days), while Term B represents the standard payment terms (e.g., net 60 days). The tool calculates the implied annual cost of not taking the discount, expressed as an APR, helping you understand whether paying early is financially advantageous or if you’re better off using that cash elsewhere in your business.

Key Features:

- Multi-currency support – Calculate in INR or other currencies

- Flexible payment terms – Compare any two payment scenarios

- Cash flow impact analysis – Optional invoices/month field to see monthly implications

- Instant APR calculation – Understand the true cost of payment timing

- Discount comparison – Evaluate multiple vendor offers side-by-side

Why Use a Vendor Payment Terms Calculator?

1. Make Informed Financial Decisions

Understanding the APR of early payment discounts reveals whether taking a discount is equivalent to a high-return investment or an expensive use of cash.

2. Optimize Working Capital

By calculating the cost of different payment terms, you can strategically manage cash flow while maximizing vendor relationship benefits.

3. Compare Vendor Offers

Evaluate multiple vendors’ payment terms objectively to negotiate better deals and select the most cost-effective suppliers.

4. Improve Procurement Strategy

Integrate payment term analysis into your procurement process to balance cost savings with liquidity management.

How to Use the Vendor Payment Terms Analyzer

Step 1: Enter Basic Information

- Currency: Select your operating currency (₹ INR, USD, EUR, etc.)

- Invoice amount: Enter the typical invoice value per transaction

- Invoices/month (optional): Add this to see monthly cash flow impact

Step 2: Define Payment Terms

- Term A days: Enter the early payment deadline (e.g., 10 days)

- Discount A: Input the discount percentage offered (e.g., 2%)

- Disc days A: Specify the discount window in days (e.g., 10)

- Term B days: Enter the standard payment deadline (e.g., 60 days)

- Discount B: Add any discount for Term B if applicable

- Disc days B: Specify discount window for Term B

Step 3: Analyze Results

Click Analyze to instantly see:

- Pay days (A): Effective payment timing for Term A

- Pay days (B): Effective payment timing for Term B

- Days saved (B → A): How many days earlier you’d pay with Term A

- Effective APR: The annualized cost of not taking the discount

- Net impact: Monthly and annual financial implications

Understanding Your Results

What is APR in Payment Terms?

The Annual Percentage Rate (APR) represents the annualized cost of forgoing an early payment discount. For example, standard 2/10 net 30 terms (2% discount if paid in 10 days, otherwise due in 30 days) translate to approximately 36.7% APR—meaning you’re effectively “borrowing” money at that rate by deferring payment.

When Should You Take the Discount?

Take the discount when:

- The APR exceeds your cost of capital or investment return rate

- You have sufficient cash reserves

- The discount significantly improves your profit margins

- Building stronger vendor relationships is strategically important

Skip the discount when:

- The APR is lower than alternative uses for that cash

- Cash flow is tight and preservation is critical

- You can earn higher returns investing that capital elsewhere

- Payment terms are already favorable (low implied APR)

Common Vendor Payment Terms Explained

2/10 Net 30

Take 2% discount if paid within 10 days, otherwise full payment due in 30 days. Implied APR: ~36.7% — usually worth taking.

1/15 Net 60

Take 1% discount if paid within 15 days, otherwise due in 60 days. Implied APR: ~8.1% — evaluate based on your cost of capital.

Net 30

Full payment due within 30 days, no discount offered. Standard terms with no early payment incentive.

Net 60 or Net 90

Extended payment terms often offered to larger customers or in B2B relationships. Preserves cash flow but may cost more than discounted options.

Industry Applications

Manufacturing & Distribution

Optimize inventory financing by analyzing supplier payment terms against carrying costs and production schedules.

Retail & E-commerce

Balance cash flow needs during seasonal fluctuations while maximizing vendor discount opportunities.

Professional Services

Manage client payment collections against vendor obligations to maintain healthy working capital ratios.

Startups & Small Businesses

Stretch limited cash resources strategically by prioritizing high-APR discount opportunities and deferring low-APR payments.

Frequently Asked Questions (FAQ)

Q: What does 2/10 net 30 mean?

A: This payment term means you receive a 2% discount if you pay within 10 days; otherwise, the full amount is due within 30 days. The implied annual cost of not taking this discount is approximately 36.7%, making it almost always worthwhile to pay early if you have the cash available.

Q: How is the APR calculated for payment terms?

A: The APR calculation uses the formula: (Discount % / (100% - Discount %)) × (365 / (Payment Period - Discount Period)). This annualizes the cost of forgoing the discount over the number of days you defer payment.

Q: What’s considered a good APR for early payment discounts?

A: Generally, if the implied APR exceeds 10-15% (your typical cost of capital), taking the discount is financially advantageous. APRs above 20-30% represent excellent opportunities that usually outperform alternative uses of cash.

Q: Should I always take early payment discounts?

A: Not always. Consider your cash position, alternative investment opportunities, and overall cost of capital. If the implied APR is lower than what you’d pay for financing or earn on investments, you might be better off preserving cash and paying later.

Q: Can I use this tool to negotiate better payment terms?

A: Absolutely! Understanding the APR helps you negotiate from an informed position. You can propose alternative discount structures that work better for both parties or demonstrate why certain terms aren’t financially viable.

Q: What if my vendor offers multiple discount tiers?

A: Use the calculator multiple times to compare each tier separately. Enter one discount scenario as Term A and the next as Term B to see which offers the best effective rate.

Q: How does invoice volume affect my decision?

A: Enter your monthly invoice count in the optional field to see cumulative impact. High-volume scenarios can significantly affect working capital, making the APR analysis even more critical for informed decisions.

Q: What’s the difference between payment terms and credit terms?

A: Payment terms specify when payment is due (e.g., net 30), while credit terms include both the payment deadline and any discounts offered (e.g., 2/10 net 30). This tool analyzes complete credit terms including discount opportunities.

Q: Can I compare terms from different vendors?

A: Yes! Run the calculation for each vendor’s terms separately, then compare the effective APRs side-by-side. This reveals which vendor offers the most favorable financial terms, not just the lowest sticker price.

Q: What if the calculator shows a negative APR?

A: A negative APR would indicate you’re being penalized for early payment, which is unusual. Double-check your inputs—typically, Term A should have the discount and shorter payment window.

Q: How often should I review vendor payment terms?

A: Review terms quarterly or whenever your cash position significantly changes. Market conditions, interest rates, and your cost of capital fluctuate, affecting whether taking discounts remains optimal.

Q: Does this tool account for payment processing costs?

A: No, the calculator focuses purely on the time value of money. When making final decisions, factor in wire transfer fees, credit card processing costs, or other payment-related expenses that might affect net savings.

Q: Can startups with limited cash still benefit from this analysis?

A: Definitely. Startups should prioritize high-APR discount opportunities (30%+) while strategically deferring lower-APR payments. This maximizes the value of every dollar in your limited cash reserves.

Q: What’s better: 2/10 net 30 or 1/15 net 60?

A: The 2/10 net 30 terms (≈36.7% APR) are significantly better than 1/15 net 60 (≈8.1% APR) from a pure return perspective. However, the latter preserves cash flow for 30 additional days, which might be valuable depending on your situation.

Q: How do payment terms affect my Days Payable Outstanding (DPO)?

A: Taking early payment discounts reduces DPO, which decreases cash conversion cycle but may strain liquidity. The calculator helps you balance these competing priorities by quantifying the financial trade-off.

Maximize Your Financial Strategy Today

Whether you’re managing vendor relationships, optimizing working capital, or negotiating better payment terms, the Vendor Payment Terms Analyzer provides the financial intelligence you need to make confident decisions. Start analyzing your payment terms now to unlock hidden savings and improve your cash flow management.

Ready to optimize your vendor payments? Enter your terms above and discover the true cost of your payment decisions.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Personal Loan EMI Calculator

- Home Loan EMi Calculator

- SIP Calculator

- SIP Goal Calculator

- CAGR Calculator

- XIRR Calculator

- SWP Calculator

- STP Calculator

- Free Lumpsum Investment Calculator: Maximize the Future Value

- CSV to JSON Converter

- QR Code Generator

- CSV to Excel Converter

- Base64 Encoder/Decoder

- Regex Tester

- JSON Formatter & Validator

- UUID Generator

- Strong Password Generator

- Lorem Ipsum Generator

- URL Encoder & Decoder

- HTML escape-unescaped tools

- JPG to PDF Converter

- PDF to JPG Converter

- PDF Compressor

- PDF Merge

- Case Converter

- Break-Even Calculator

- ROI Calculator

- Free Profit Margin Calculator – Calculate Profit Margins Instantly

- Startup Runway & Burn Rate Calculator – Calculate Cash Runway Free

- Free Working Capital Calculator | Free Tool- ToolSuite.in

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM