Startup Runway & Burn Rate Calculator

Know How Many Months Your Startup Can Survive — Measure Burn, Model Scenarios, and Plan Your Next Raise with Confidence

Understanding your startup runway and burn rate is critical for survival and strategic planning. Our free startup runway calculator helps founders, entrepreneurs, and finance teams instantly calculate how many months their startup can survive with current cash reserves, measure monthly burn rate accurately, model different financial scenarios, and plan fundraising rounds with data-driven confidence.

Whether you’re a bootstrapped startup watching every dollar, a venture-backed company planning your Series A, or a founder preparing investor presentations, this burn rate calculator provides the financial clarity you need to make informed decisions and avoid running out of cash.

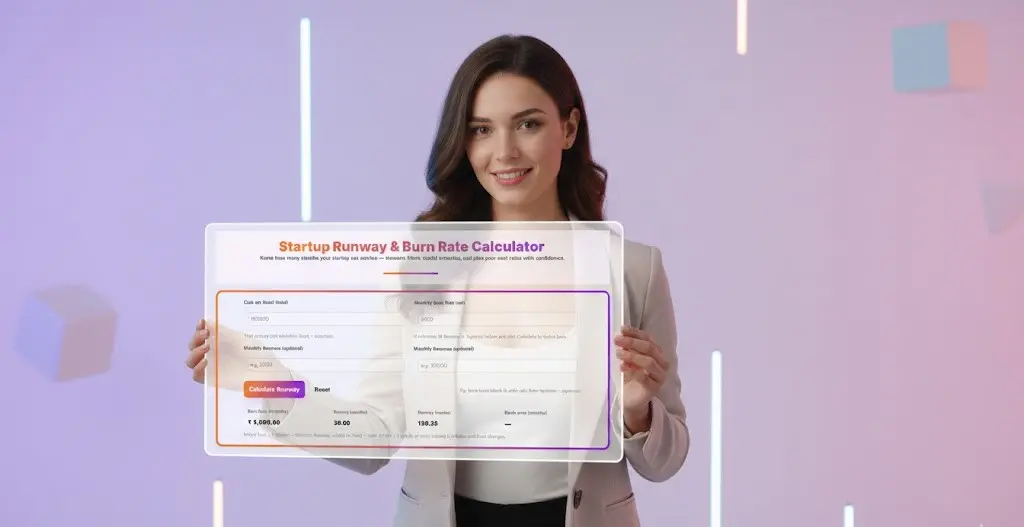

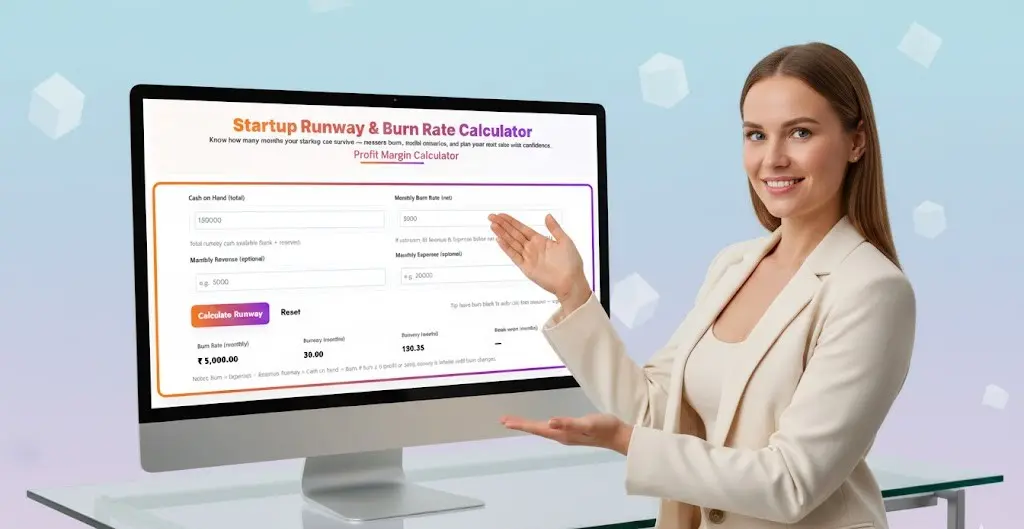

Startup Runway & Burn Rate Calculator

Know how many months your startup can survive — measure burn, model scenarios, and plan your next raise with confidence.

What is Startup Runway?

Startup runway is the amount of time your company can continue operating before running out of money, typically measured in months or weeks. It’s calculated by dividing your total cash on hand by your monthly burn rate. For example, if you have ₹150,000 in the bank and burn ₹5,000 monthly, your runway is 30 months.

Runway is one of the most critical metrics for startup survival. Running out of runway means running out of business unless you secure additional funding, achieve profitability, or drastically cut costs. Smart founders monitor runway constantly and begin fundraising with at least 6-12 months of runway remaining.

What is Burn Rate?

Burn rate is the rate at which your startup spends cash, typically expressed as a monthly amount. It represents how much money you’re “burning through” each month to operate your business. There are two types of burn rate:

Gross Burn Rate: Total monthly expenses regardless of revenue (e.g., ₹20,000 in monthly expenses).

Net Burn Rate: Monthly expenses minus monthly revenue (e.g., ₹20,000 expenses – ₹15,000 revenue = ₹5,000 net burn).

Our calculator focuses on net burn rate, which gives you a realistic picture of how quickly you’re depleting cash reserves after accounting for incoming revenue. Lower burn rates extend runway, while higher burn rates require faster revenue growth or additional fundraising.

Why Use a Startup Runway Calculator?

Avoid Running Out of Cash

The number one reason startups fail is running out of money. Our runway calculator helps you know exactly how long you can survive, giving you adequate warning to secure funding or adjust operations before it’s too late.

Plan Fundraising Timing

Fundraising takes 3-6 months on average. By knowing your runway, you can start raising capital with enough cushion to negotiate favorable terms rather than accepting unfavorable deals out of desperation.

Make Informed Hiring Decisions

Understand whether you can afford new hires by modeling how additional salary expenses affect your runway. Make strategic growth investments only when you have sufficient runway to support them.

Evaluate Business Model Changes

Model different scenarios by adjusting revenue and expenses to see how business decisions impact runway. Test whether launching new products, cutting costs, or changing pricing extends or shortens survival time.

Communicate with Stakeholders

Present clear, data-driven runway metrics to investors, board members, and executive teams. Demonstrate financial awareness and planning competence that builds confidence.

Set Milestone Goals

Use runway calculations to set realistic timelines for achieving key milestones like product launches, revenue targets, or profitability that align with your available cash.

How to Use the Startup Runway & Burn Rate Calculator

Our burn rate calculator is designed for speed and accuracy, giving you instant insights into your startup’s financial runway with just a few inputs.

Step-by-Step Calculation Process

Step 1: Enter Cash on Hand (Total) Input your total available runway cash including bank balances and reserves. This should include all liquid assets available to fund operations. For example, enter 150000 if you have ₹1,50,000 in your business bank account plus reserves.

Important: Only include cash you’re willing to spend on operations. Don’t include emergency reserves you need to preserve or restricted funds earmarked for specific purposes.

Step 2: Enter Monthly Burn Rate (Net) If you know your net burn rate, enter it directly. This is your monthly expenses minus monthly revenue. For example, enter 5000 if you spend ₹20,000 monthly but generate ₹15,000 in revenue, giving you a ₹5,000 net burn.

Tip: If you’re unsure of your burn rate, leave this blank initially and use the optional fields below to calculate it automatically.

Step 3: Enter Monthly Revenue (Optional) Input your average monthly revenue or income. This can be left blank if you already entered net burn rate above. For example, enter 5000 if your startup generates ₹5,000 in monthly recurring revenue.

Step 4: Enter Monthly Expenses (Optional) Input your total monthly expenses including salaries, rent, software subscriptions, marketing costs, server expenses, and all operational costs. For example, enter 20000 if your monthly expenses total ₹20,000.

Auto-Calculation Feature: If you fill in Monthly Revenue and Monthly Expenses but leave Burn Rate blank, the calculator automatically derives your net burn rate by subtracting revenue from expenses.

Step 5: Click Calculate Runway Hit the “Calculate Runway” button to instantly see your comprehensive results displayed in four key metrics:

- Burn Rate (monthly): Your net monthly cash burn (₹5,000.00 in example)

- Runway (months): How many months until you run out of cash (30.00 in example)

- Runway (weeks): Your runway expressed in weeks for precision (130.35 in example)

- Break-even (months): When you’ll achieve break-even (— if not applicable)

Step 6: Reset for New Scenarios Use the Reset button to clear all fields and model different scenarios. Test how hiring decisions, cost cuts, or revenue changes impact your runway by running multiple calculations.

Understanding the Calculation Formulas

Our calculator uses standard startup financial formulas:

Net Burn Rate Formula: Burn Rate = Monthly Expenses − Monthly Revenue

Runway in Months Formula: Runway (months) = Cash on Hand ÷ Monthly Burn Rate

Runway in Weeks Formula: Runway (weeks) = Runway (months) × 4.345 (average weeks per month)

Break-even Formula: Break-even occurs when Monthly Revenue ≥ Monthly Expenses (Burn Rate = ₹0)

Important Note: If burn rate ≤ 0 (meaning you’re profitable or breaking even), runway is infinite until burn changes, shown as “—” in the break-even field.

Key Features of Our Runway Calculator

Dual Input Methods

Calculate runway either by entering net burn rate directly, or by entering separate revenue and expense figures to automatically derive burn rate. This flexibility accommodates different levels of financial data availability.

Multiple Runway Formats

View runway in both months and weeks for different planning needs. Monthly runway is better for high-level strategy, while weekly runway provides precision for short-term cash management.

Break-Even Analysis

See when you’ll reach break-even based on current financial trajectory. This helps you understand whether you’re on a path to profitability or need intervention.

Instant Real-Time Calculations

Get immediate results without page loads or delays. Adjust inputs and see how changes impact runway instantly, perfect for scenario modeling during planning meetings.

Mobile-Accessible Design

Calculate runway on any device—laptop, tablet, or smartphone. Check your startup’s financial health on the go before investor meetings or during team discussions.

One-Click Reset

Model multiple scenarios quickly with instant field clearing. Compare different hiring plans, cost structures, or revenue projections without manual data deletion.

No Registration Required

Use this critical startup tool completely free without accounts, subscriptions, or email collection. Access unlimited calculations whenever you need financial clarity.

Clear Formula Notes

Understand exactly how calculations work with transparent formulas displayed below results, helping you learn startup financial management principles.

Understanding Your Runway Calculation Results

Burn Rate (Monthly)

This shows your net monthly cash burn—the amount you’re spending beyond what you’re earning each month. Using our example: ₹5,000.00 means you’re depleting cash reserves by ₹5,000 every month.

Interpretation: Higher burn rates require either faster revenue growth or more fundraising. Lower burn rates extend runway and provide more time to achieve milestones. Negative burn (profitability) means infinite runway.

Runway (Months)

The number of months your startup can survive with current cash and burn rate. In our example: 30.00 months means you have 2.5 years of runway at current spending levels.

Interpretation: Less than 6 months is critical—start fundraising immediately. 6-12 months requires active fundraising planning. 12-24 months is healthy for most startups. Over 24 months provides excellent strategic flexibility.

Runway (Weeks)

Your survival time expressed in weeks for more precise planning. Example: 130.35 weeks provides granular insight for short-term financial decisions.

Interpretation: Weekly runway is particularly useful when you’re down to less than 6 months, as it helps track burn more precisely and identify the exact week you need funding by.

Break-Even (Months)

Shows when you’ll achieve cash flow break-even at current trajectory. In our example: “—” indicates break-even isn’t applicable because we’re already profitable or the calculator needs more data.

Interpretation: If break-even shows a number, that’s how many months until your revenue covers expenses. If it shows “—”, you’re either profitable, breaking even, or haven’t provided revenue/expense data.

Startup Runway Benchmarks and Guidelines

Runway Length Recommendations

Critical Zone (0-3 months): Emergency situation requiring immediate action—secure bridge funding, drastically cut costs, or pivot quickly. Minimal negotiating power with investors.

Danger Zone (3-6 months): High risk period—begin intensive fundraising immediately, prepare for down-round possibilities, consider strategic partnerships or acquisition discussions.

Warning Zone (6-12 months): Time to start fundraising process actively. Develop pitch deck, identify target investors, model different scenarios, and plan milestone achievements before cash depletes.

Healthy Zone (12-18 months): Good position for most startups. Sufficient time to achieve meaningful milestones, run proper fundraising process, and negotiate favorable terms with investors.

Strong Zone (18-24 months): Excellent runway providing strategic flexibility. Can be selective with investors, focus on growth over survival, and optimize for best long-term partnership.

Exceptional Zone (24+ months): Outstanding position allowing focus purely on execution and growth. Minimal fundraising pressure, maximum negotiating leverage if you choose to raise.

Burn Rate Benchmarks by Stage

Pre-Seed Startups: ₹50,000-₹2,00,000 monthly burn is typical for small teams focused on product development with minimal marketing spend.

Seed Stage Startups: ₹2,00,000-₹10,00,000 monthly burn as you hire initial team, develop MVP, and begin early customer acquisition.

Series A Startups: ₹10,00,000-₹50,00,000 monthly burn while scaling team, ramping marketing, and pursuing rapid growth.

Series B+ Startups: ₹50,00,000+ monthly burn focused on market domination, geographic expansion, and category leadership.

Remember: burn rate should correlate with stage, growth rate, and path to profitability. Unsustainable burn without clear ROI is dangerous regardless of stage.

Real-World Startup Runway Calculation Examples

Example 1: Early-Stage SaaS Startup

Financial Details:

- Cash on Hand: ₹1,50,000

- Monthly Burn Rate: ₹5,000 (net)

- Monthly Revenue: ₹5,000

- Monthly Expenses: ₹10,000

Calculator Results:

- Burn Rate: ₹5,000/month

- Runway: 30.00 months

- Runway: 130.35 weeks

- Break-even: —

Analysis: Excellent 30-month runway provides ample time to scale revenue without immediate fundraising pressure. Should focus on growth rather than survival.

Example 2: Bootstrapped E-commerce Startup

Financial Details:

- Cash on Hand: ₹3,00,000

- Monthly Revenue: ₹80,000

- Monthly Expenses: ₹1,00,000

- Net Burn: ₹20,000

Calculator Results:

- Burn Rate: ₹20,000/month

- Runway: 15.00 months

- Runway: 65.18 weeks

- Break-even: Approaching within months

Analysis: Healthy 15-month runway with strong revenue. Close to break-even, so focus should be on small optimizations to eliminate burn entirely and achieve profitability.

Example 3: Venture-Backed Mobile App

Financial Details:

- Cash on Hand: ₹75,00,000

- Monthly Revenue: ₹5,00,000

- Monthly Expenses: ₹25,00,000

- Net Burn: ₹20,00,000

Calculator Results:

- Burn Rate: ₹20,00,000/month

- Runway: 3.75 months

- Runway: 16.29 weeks

- Break-even: Many months away

Analysis: Critical situation with under 4 months runway despite substantial cash. Immediate action required—either raise emergency funding, drastically cut costs, or accelerate revenue growth substantially.

Example 4: Profitable Consulting Startup

Financial Details:

- Cash on Hand: ₹8,00,000

- Monthly Revenue: ₹3,00,000

- Monthly Expenses: ₹2,00,000

- Net Burn: -₹1,00,000 (profitable!)

Calculator Results:

- Burn Rate: -₹1,00,000/month

- Runway: Infinite (profitable)

- Break-even: Already achieved

Analysis: Negative burn means profitability—congratulations! Runway is infinite as you’re adding ₹1,00,000 to cash reserves monthly. Focus on strategic growth investments and scaling profitably.

Strategies to Extend Your Startup Runway

Reduce Monthly Expenses

Audit every expense line item rigorously. Eliminate unused software subscriptions, renegotiate vendor contracts, consider remote work to cut office costs, reduce discretionary spending on perks and events, and outsource non-core functions instead of hiring full-time.

Increase Monthly Revenue

Focus intensely on sales and customer acquisition. Implement aggressive pricing strategies, launch upselling campaigns to existing customers, accelerate sales cycles with special promotions, explore new distribution channels, and consider strategic partnerships for rapid customer access.

Optimize Team Structure

Evaluate whether every role directly contributes to revenue or critical milestones. Consider contractors versus full-time employees for non-core roles, implement hiring freezes until revenue increases, prioritize multi-skilled team members who can wear multiple hats.

Secure Bridge Funding

If runway is critical, seek bridge financing from existing investors, angels, or convertible notes to buy time. Even small amounts ($25,000-$100,000) can extend runway by months and prevent shutdown.

Pursue Strategic Partnerships

Look for partnership opportunities that provide cash, resources, or revenue-sharing arrangements. Strategic partnerships can reduce burn while accelerating growth through shared resources.

Consider Pivot or Transition

If current model isn’t working, consider pivoting to adjacent markets, different business models, or even acqui-hire opportunities before completely depleting runway.

Implement Revenue-Based Financing

Explore alternative funding like revenue-based financing that doesn’t dilute equity and provides immediate cash injection based on recurring revenue streams.

Common Runway Calculation Mistakes to Avoid

Only Counting Bank Balance

Include all available cash sources—checking accounts, savings, money market funds, and any reserves you’re willing to deploy. Underestimating cash artificially shortens runway calculations.

Ignoring Upcoming Large Expenses

If you have annual insurance payments, tax bills, or planned equipment purchases coming up, factor these into burn rate or subtract from available cash for accurate runway.

Forgetting About Revenue Seasonality

Many businesses have seasonal revenue patterns. Calculate runway using average monthly revenue across seasons, not peak months, to avoid false confidence.

Using Gross Burn Instead of Net Burn

Always use net burn rate (expenses minus revenue) for runway calculations. Gross burn ignores your income and drastically understates actual runway.

Not Updating Calculations Regularly

Runway changes constantly as revenue grows or contracts and as you adjust spending. Recalculate at least monthly, weekly when runway is under 6 months.

Planning Fundraising Too Late

Remember fundraising takes 3-6 months minimum. Start raising when you have 12+ months runway, not when you’re down to 3-4 months and desperate.

Assuming Linear Burn Rate

Burn often increases as you grow—new hires, larger marketing budgets, bigger offices. Project future burn increases when planning runway, not just current burn.

Frequently Asked Questions About Startup Runway Calculator

Q: How often should I calculate my startup runway?

A: Calculate runway at least monthly as part of your regular financial review process. If runway is under 6 months, calculate weekly to maintain precise awareness of your financial situation. Many successful founders check runway before every major financial decision—hiring, marketing campaigns, office leases—to ensure they’re not shortening runway below safe levels. Setting calendar reminders for runway calculations ensures you never lose track of this critical metric.

Q: What’s the difference between gross burn and net burn rate?

A: Gross burn rate is your total monthly expenses regardless of revenue, showing how much you spend to operate. Net burn rate subtracts monthly revenue from expenses, showing actual cash depletion rate. Our calculator focuses on net burn because it provides realistic runway—if you spend ₹20,000 but earn ₹15,000, your net burn of ₹5,000 is what actually depletes your cash reserves. Net burn is the more important metric for runway calculations.

Q: What’s considered a good runway for a startup?

A: For most startups, 12-18 months of runway is healthy, providing adequate time to achieve milestones and raise the next round. Under 6 months is dangerous territory requiring immediate action. Over 24 months is exceptional, giving you maximum strategic flexibility. However, “good” runway depends on your specific situation—early-stage bootstrapped startups might operate with 6-9 months comfortably, while venture-backed companies planning large Series A raises should maintain 12+ months minimum.

Q: Should I include restricted funds in my cash on hand?

A: No, only include cash you’re actually willing to spend on operations. Exclude emergency reserves you’ve committed to preserving, personal funds you’re not ready to invest, restricted grants that can only be used for specific purposes, or money earmarked for specific future expenses. Your runway calculation should reflect truly available operational cash, not theoretical maximum funds.

Q: How do I calculate burn rate if my expenses vary monthly?

A: Calculate your average monthly expenses over the past 3-6 months for the most accurate burn rate. Add up total expenses for this period and divide by the number of months. This smooths out one-time expenses and seasonal variations, giving you a realistic average burn rate. For revenue, also use 3-6 month averages unless you’ve recently launched and your revenue trajectory is rapidly changing.

Q: What if my runway calculation shows infinite months?

A: Infinite runway means you’re profitable or breaking even—your monthly revenue meets or exceeds monthly expenses, so you’re not depleting cash reserves. This is excellent! However, don’t become complacent. Continue monitoring finances closely, maintain cash reserves for unexpected situations, and consider reinvesting profits into strategic growth initiatives that can accelerate your success.

Q: When should I start fundraising based on my runway?

A: Start your fundraising process when you have 12-18 months of runway remaining. Fundraising typically takes 3-6 months from first investor conversations to cash in bank, and you want buffer time in case it takes longer or you need multiple attempts. Starting early provides negotiating leverage—investors can sense desperation when you’re at 3-4 months runway, resulting in worse terms or difficulty closing rounds.

Q: How does hiring affect my startup runway?

A: Each new hire increases your monthly burn rate by their fully-loaded cost (salary + benefits + taxes + equipment), which directly reduces runway. Before hiring, model the impact: if your burn is ₹5,000 and runway is 30 months, adding a ₹3,000/month employee increases burn to ₹8,000 and cuts runway to 18.75 months. Only hire when you have sufficient runway buffer and confidence the hire will eventually increase revenue or achieve critical milestones.

Q: Can I use this calculator for break-even analysis?

A: Yes! Enter your current monthly revenue and expenses to see when you’ll reach break-even (when revenue equals expenses). The calculator shows whether you’re approaching break-even or still far from it. You can also model scenarios—calculate what revenue level you’d need to achieve break-even by adjusting the monthly revenue field until burn rate approaches zero.

Q: What should I do if my runway is less than 6 months?

A: This is critical and requires immediate action. Options include: (1) Start emergency fundraising immediately with existing investors or angels, (2) Drastically cut expenses—freeze hiring, reduce marketing, renegotiate contracts, (3) Accelerate revenue through promotions, price increases, or sales focus, (4) Seek bridge financing to buy time for proper fundraising, (5) Consider strategic partnerships or acquisition conversations. Don’t wait—act decisively within days, not weeks.

Q: How do I account for planned fundraising in runway calculations?

A: Calculate runway based on current cash only, not anticipated funding. Fundraising is uncertain—deals fall through, timelines extend, amounts change. Plan assuming fundraising might fail or take 2x longer than expected. Once funding is confirmed and in the bank, then update your runway calculation with the new cash on hand to reflect your extended runway.

Q: Should I share runway information with my team?

A: This depends on company culture and runway length. If runway is healthy (12+ months), sharing can build trust and financial transparency. If runway is critical (<6 months), sharing might cause panic, distraction, or talent departure. Many founders share burn rate and expense consciousness without specific runway numbers, or share runway information only with leadership team members who need it for strategic planning.

Start Calculating Your Startup Runway Today

Understanding your startup runway and burn rate is fundamental to survival and strategic success. Whether you’re a first-time founder, experienced entrepreneur, CFO, or financial planner, our startup runway calculator provides the instant financial clarity you need to make confident decisions and avoid running out of cash.

Know how many months your startup can survive—calculate your runway now and plan your next raise with confidence!

Simply enter your cash on hand and monthly burn rate (or let the calculator derive burn from your revenue and expenses) to instantly see your runway in months and weeks, understand your burn rate, and evaluate your path to break-even.

Use this essential startup tool to:

- Monitor financial health and survival timeline

- Plan fundraising timing strategically

- Make informed hiring and spending decisions

- Model different business scenarios

- Communicate financial status to stakeholders

- Set realistic milestone timelines

- Avoid the #1 reason startups fail: running out of money

Start using the startup runway calculator now and take control of your startup’s financial future. Calculate regularly, model scenarios proactively, and ensure your startup has the runway needed to achieve its ambitious goals.

Ready to know how long your startup can survive? Use our free runway calculator above to get instant answers!

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Personal Loan EMI Calculator

- Home Loan EMi Calculator

- SIP Calculator

- SIP Goal Calculator

- CAGR Calculator

- XIRR Calculator

- SWP Calculator

- STP Calculator

- Free Lumpsum Investment Calculator: Maximize the Future Value

- CSV to JSON Converter

- QR Code Generator

- CSV to Excel Converter

- Base64 Encoder/Decoder

- Regex Tester

- JSON Formatter & Validator

- UUID Generator

- Strong Password Generator

- Lorem Ipsum Generator

- URL Encoder & Decoder

- HTML escape-unescaped tools

- JPG to PDF Converter

- PDF to JPG Converter

- PDF Compressor

- PDF Merge

- Case Converter

- Break-Even Calculator

- ROI Calculator

- Free Profit Margin Calculator – Calculate Profit Margins Instantly

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM