HRA Exemption Calculator India — Old Regime | Free Online Tool

Calculate accurate HRA exemption in seconds using our free HRA Calculator India. Enter your salary, HRA received, rent paid and city type (metro/non-metro) to get exact HRA exempt and taxable HRA under the Old Tax Regime.

Want more tools, please explore our tools directory overview and free tools page categories.

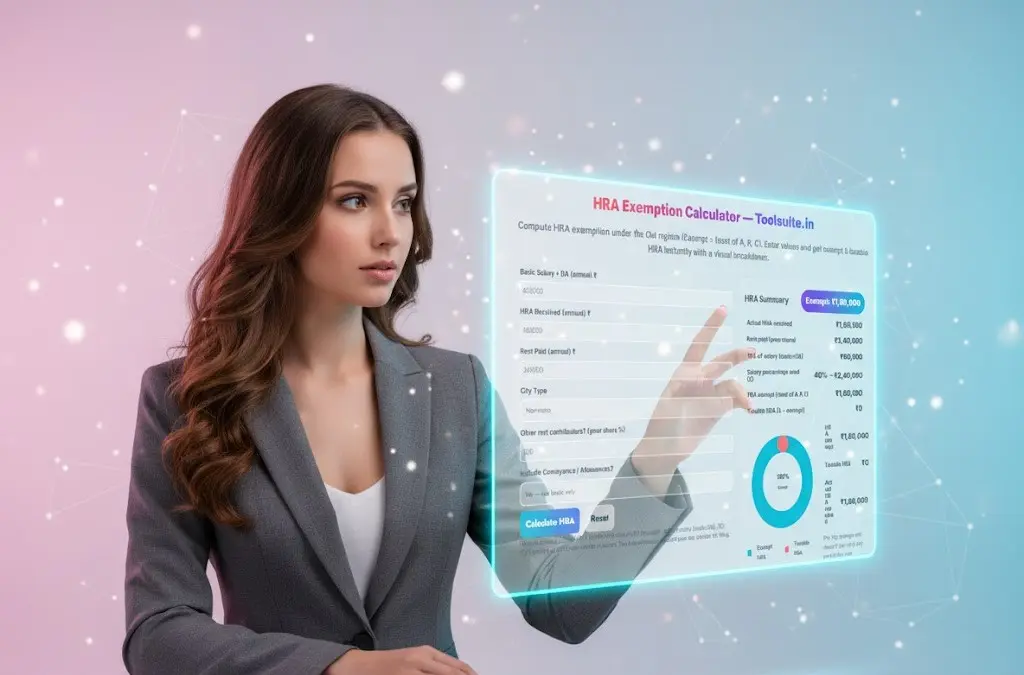

HRA Exemption Calculator — Toolsuite.in

Compute HRA exemption under the Old regime (Exempt = least of A, B, C). Enter values and get exempt & taxable HRA instantly with a visual breakdown.

Method: Exempt = least of (A) Actual HRA received; (B) Rent paid − 10% of salary (basic+DA); (C) 50% (metro) or 40% (non-metro) of salary. This is an estimator — consult your tax advisor for filing.

Understanding HRA Exemption — Complete Guide (Old Tax Regime, FY 2025-26)

House Rent Allowance (HRA) is one of the most important tax-saving components for salaried employees in India. Under the Old Tax Regime, HRA can significantly reduce your taxable income if you live in a rented house and meet certain conditions.

This page explains how HRA exemption is calculated, the eligibility rules, legal provisions, and how to use the Toolsuite.in HRA Calculator to estimate your tax savings instantly.

What is HRA (House Rent Allowance)?

HRA is a salary component paid by employers to employees to meet rental expenses. While HRA is part of your salary, a portion of it becomes tax-exempt under Section 10(13A) of the Income Tax Act if:

- You live in rented accommodation

- You actually pay rent

- You have rent receipts or rent agreement as proof

- Your employer pays HRA as part of your salary

How HRA Exemption is Calculated (A, B, C Rule)

Under Section 10(13A) and Rule 2A of the Income Tax Rules, HRA exemption equals the least of the following three:

A — Actual HRA received

This is the HRA amount in your salary structure.

B — Rent Paid – 10% of Salary (Basic + DA)

Only the rent exceeding 10% of salary is tax deductible.

C — 50% of Salary (Metro) or 40% (Non-Metro)

Metro cities: Mumbai, Delhi, Chennai, Kolkata

Non-metro: All other cities

Final HRA Exempt = Least of A, B or C

The remaining HRA becomes taxable HRA.

Legal Provisions You Must Know

Section 10(13A) – Income Tax Act, 1961

Provides eligibility and conditions for HRA exemption.

Rule 2A – Income Tax Rules

Prescribes the method of computation (A/B/C formula).

Proofs required for claiming HRA

- Rent receipts

- Rent agreement

- PAN of landlord (mandatory if rent > ₹1,00,000 per year)

- Bank transfer proof (recommended)

Important Notes

- HRA exemption is NOT available under the New Tax Regime (except limited employer-driven allowances in special cases).

- You cannot claim both HRA exemption and home loan interest u/s 24 for the same property unless you are working in a different city and renting separately.

- If living with parents, you can claim HRA if you actually pay rent and parents declare rental income.

How to Use the Toolsuite.in HRA Exemption Calculator

Our calculator is designed for speed, accuracy and clarity. Here’s how to use it:

Step 1: Enter Basic Salary + DA

- Enter your annual Basic + DA (since HRA rules use basic salary only).

Step 2: Enter HRA Received

- Enter the annual HRA component from your salary slip.

Step 3: Enter Rent Paid

- Enter your total annual rent (you can add rent share % if rent is split with family/roommates).

Step 4: Choose City Type

- Metro: 50% limit

- Non-Metro: 40% limit

Step 5: Review Results

You will instantly see:

- Actual HRA received

- 10% of salary

- Rent eligible for exemption

- Metro/Non-metro limit

- Final exempt HRA

- Taxable HRA

- A visual donut chart showing exempt vs taxable HRA

Step 6: Use results for tax planning

- Use the exempt HRA while computing your income under the Old Tax Regime.

FAQs — HRA Exemption Calculator

1. Is HRA exempt under New Tax Regime?

No. Under the New Regime, HRA exemption under Section 10(13A) is not available.

2. What if I live with parents? Can I claim HRA?

Yes — if you pay rent to your parents and have valid proof. Parents must show the rent as income.

3. Can I claim both HRA and home loan interest?

Yes, if your owned house is in a different city and you are renting due to employment.

No, if both are for the same property.

4. What if rent is shared among family or roommates?

You can claim exemption only for your share of rent.

5. Is PAN of landlord required?

PAN of landlord is mandatory if annual rent > ₹1,00,000.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Simple and easy to use EMI Calculator

- GST Calculator

- For detailed finance and tax resources, visit TaxBizmantra.com