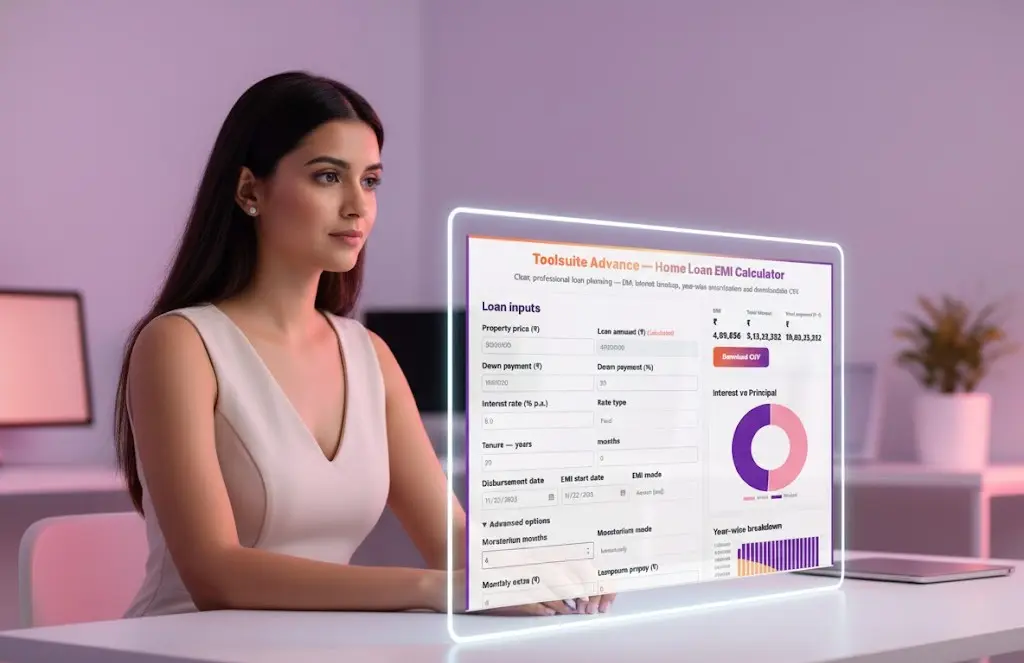

Toolsuite Advance — Home Loan EMI Calculator

Calculate your EMI, interest payable, and year-wise loan breakup instantly using our advanced Home Loan EMI Calculator. This smart tool gives clear insights into monthly payments, principal vs interest, and a downloadable amortization schedule.

Toolsuite Advance — Home Loan EMI Calculator

Loan inputs

Advanced options

Amortization schedule

| # | Date | Opening | Payment | Interest | Principal | Prepay | Closing |

|---|

Values rounded to nearest rupee. Use CSV to export full data.

Home Loan EMI Calculator — Complete Guide, Financial Concepts & How to Use

Buying a home is a major financial milestone, and understanding the repayment structure is extremely important before finalising a loan. The Toolsuite Home Loan EMI Calculator helps you compute EMI, analyse interest outflow, plan prepayments, and understand your loan duration with complete clarity.

This page explains every key financial term — home loan EMI, interest rate, tenure, moratorium, prepayment, amortization schedule — in simple, professional language.

How to Use This Home Loan EMI Calculator

Follow these simple steps to calculate your EMI:

Step 1: Enter Property Price

Enter the total price of your home or flat.

Step 2: Enter Down Payment (₹ or %)

You may enter:

- Down payment in rupees, or

- Down payment percentage (like 20%)

The calculator will automatically compute the loan amount.

Step 3: Enter Interest Rate

Provide the annual interest rate (e.g., 8.5%).

This directly impacts your EMI.

Step 4: Select Rate Type

Choose:

- Fixed Rate, or

- Floating Rate

Step 5: Enter Loan Tenure

Input tenure in:

- Years

- Extra Months (if any)

Step 6: Choose Dates

Pick:

- Disbursement date

- EMI start date

- EMI mode (Advance or Arrears)

Step 7: Use Advanced Options (Optional)

You can add:

- Moratorium period

- Extra monthly payment

- Lumpsum prepayment

- Processing fee percentage

Step 8: Click “Calculate EMI”

You will instantly see:

- EMI

- Total interest

- Total payment (Principal + Interest)

- Pie chart

- Year-wise bar graph

- Amortization table

- CSV download option

This makes the tool extremely intuitive and useful for home buyers, real estate investors, and financial planners.

1. What is a Home Loan EMI?

A Home Loan EMI (Equated Monthly Instalment) is the fixed payment you make every month to repay your home loan. It consists of:

- Principal: the loan amount

- Interest: the cost of borrowing

In early years, EMIs contain higher interest and lower principal, while later years contain higher principal and lower interest — this is the amortization effect.

2. Loan Inputs Explained

Property Price

The total cost of the property you wish to purchase.

Down Payment (₹ or %)

Your initial money contribution.

Banks typically require 20% down payment.

Loan Amount (Auto-Calculated)

Loan Amount = Property Price – Down Payment

This calculator automatically updates this field based on your input.

3. Understanding Interest Rate Types

Interest rate is one of the most crucial variables affecting EMI.

Fixed Interest Rate

- EMI remains constant

- No fluctuation

- Ideal when interest rates are rising

Floating Interest Rate

- EMI or tenure changes depending on market rates

- Usually lower than fixed rate

- Ideal for long-term loans

Your calculator supports both options, making it suitable for every borrower.

4. Loan Tenure (Years and Months)

The tenure defines the number of months you will repay the loan.

Longer tenure → lower EMI but higher interest

Shorter tenure → higher EMI but lower interest

Most home loans in India are taken for 20–30 years.

5. EMI Mode — Arrears vs Advance

Arrears Mode (Standard)

EMI is paid at the end of every month.

Advance Mode

EMI is paid at the beginning of every month.

This reduces the interest slightly.

6. Moratorium Period (Optional)

A moratorium is a temporary break from EMI payments.

Interest-Only Moratorium

You pay only the interest during the moratorium.

Interest-Accrues Moratorium

Interest is added to the principal, increasing your loan amount.

This calculator covers both scenarios so you can plan effectively.

7. Prepayment Options — Smart Ways to Reduce Interest

Your EMI calculator includes advanced repayment options:

Monthly Extra Payment

Adding an extra fixed amount every month can drastically reduce your tenure.

Lumpsum Prepayment

Great for:

- Bonus

- Incentives

- Sale of asset

- Extra savings

This reduces outstanding principal and total interest.

8. Year-Wise Amortization Schedule

The Home Loan EMI Calculator provides a complete year-wise breakdown including:

- Principal repaid each year

- Interest paid each year

- Total EMI paid

- Outstanding loan balance

- Easy-to-read graphs

- CSV download option

This helps with:

- Home loan tax planning

- Comparing loan offers

- Prepayment decisions

- Financial forecasting

Why Toolsuite Home Loan Calculator is the Best?

- Professionally designed UI with brand gradient header

- Real-time EMI calculation

- Principal vs interest pie chart

- Year-wise bar chart

- 3D amortization chart

- Downloadable CSV

- Moratorium + prepayment support

- 100% responsive and mobile-friendly

- Accurate formulas as per banking standards

This is more powerful than standard calculators provided by banks.

Frequently Asked Questions (FAQ)

1. Does my EMI change in a floating-rate home loan?

Yes, the EMI or tenure changes when interest rates change.

2. What is the ideal down payment percentage?

Most banks require at least 20%, but you can choose more to reduce EMI.

3. What is the maximum home loan tenure?

Typically 30 years, depending on age and bank policy.

4. How much can I save with prepayment?

Even 5–10% annual prepayment can save lakhs in interest.

5. Is moratorium good?

It provides temporary relief but increases your total interest.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM