TDS Deduction Estimator — Salary (Section 192)

Get an instant estimate of your monthly TDS on salary under the Old or New Tax Regime with our TDS Deduction Estimator. Enter your annual salary, exemptions and deductions to know your annual tax, surcharge, cess and monthly TDS as per Section 192 of the Income Tax Act.

Want more tools, please explore our tools directory overview and free tools page categories.

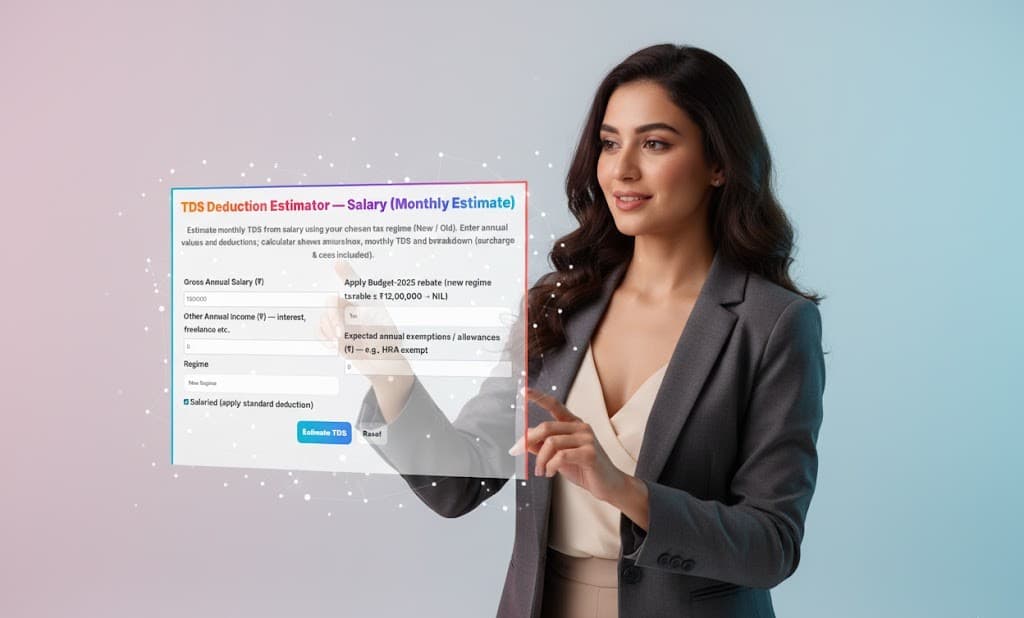

TDS Deduction Estimator — Salary (Monthly Estimate)

Estimate monthly TDS from salary using your chosen tax regime (New / Old). Enter annual values and deductions; calculator shows annual tax, monthly TDS and breakdown (surcharge & cess included).

Method: tax computed on taxable income after regime-specific deductions (standard deduction: New ₹75,000, Old ₹50,000). Surcharge & 4% cess applied. Monthly TDS = annual tax / 12 (approx). This is an estimator — final TDS depends on employer computation & declarations.

Understanding TDS on Salary Under Section 192 (India)

TDS on salary is governed entirely by Section 192 of the Income Tax Act. It requires employers to deduct tax at source based on the employee’s estimated annual taxable salary—not on fixed slab rates per month. The employer must compute projected yearly income, apply eligible exemptions and deductions, calculate total tax liability for the year, and then divide it into equal monthly TDS instalments.

Below is a simple, clear explanation of how monthly salary TDS works under Section 192.

How TDS on Salary is Calculated (Section 192)

Under Section 192, the employer must:

1. Compute Estimated Annual Taxable Salary

Includes:

- Basic salary

- Dearness allowance (if part of retirement benefits)

- HRA (only taxable portion after exemption)

- Special allowances

- Bonus, commission, incentives

- Perquisites (car, accommodation, ESOPs etc.)

- Employer contributions above taxable limits (PF, NPS, Superannuation Fund)

2. Reduce Exemptions Where Applicable

Common exemptions:

- HRA exemption under Section 10(13A)

- Leave travel allowance (LTA)

- Food allowance, uniform allowance (as per employer policy)

- Gratuity (if received on retirement/termination within limits)

3. Apply Standard Deduction

A standard deduction of ₹50,000 is available for all salaried taxpayers under both regimes (Old and New).

4. Reduce Deductions (Old Regime Only)

If employee chooses the Old Regime, deductions allowed include:

- Section 80C (LIC, PPF, PF, tuition fees, ELSS etc.)

- Section 80D (medical insurance premium)

- Section 24(b) (home loan interest — up to ₹2,00,000 for self-occupied property)

- Section 80CCD(1B) (NPS additional deduction ₹50,000)

- Section 80CCD(2) (employer NPS contribution — no upper limit for TDS purposes)

- Section 80G (donations, if employer allows)

Under the New Regime, most deductions and exemptions are not available—except:

- Standard deduction ₹50,000

- Employer NPS contribution under 80CCD(2)

5. Calculate Total Annual Tax Liability

Tax is computed based on the chosen tax regime (Old or New), including:

- Income tax on slabs

- Applicable surcharge

- 4% Health & Education Cess

6. Divide by Number of Remaining Months

The employer must divide the final tax liability by the number of months left in the financial year to determine your monthly TDS.

Key Compliance Rules Under Section 192

Regime Declaration

- Employee must declare whether they choose Old Regime or New Regime.

- If no declaration is submitted → New Regime is the default (CBDT Circular).

Proof Submission

At year-end, employee must submit proofs for:

- 80C investments

- 80D medical insurance

- Rent receipts for HRA

- Home loan interest certificate

- NPS investment receipts

If proofs differ from declarations, employer must revise TDS accordingly.

Mid-Year Joining / Switching Jobs

If an employee changes jobs:

- New employer must consider previous employer’s Form 12B

- Combined salary determines correct annual TDS

Excess or Short TDS

- Excess TDS → employee can claim refund while filing ITR

- Short TDS → employer may face interest and penalties u/s 201(1A)

How to Use This TDS Deduction Estimator

- Enter your gross annual salary

- Add any other taxable income (interest, freelance income etc.)

- Select your tax regime (Old/New)

- Enter HRA exemption or other allowed allowances

- Toggle the Budget-2025 rebate for the New Regime (taxable income ≤ ₹12,00,000 → NIL)

- View:

- Annual taxable income

- Final tax liability

- Cess and surcharge

- Monthly TDS deduction

This tool follows a simple, transparent Section 192 rule-set to help employees and employers estimate salary TDS accurately.

Frequently Asked Questions (FAQ)

1. Is TDS on salary mandatory every month?

Yes. Under Section 192, employers must deduct TDS every month from taxable salary based on estimated annual income.

2. Which tax regime is used for TDS deduction?

Employees can choose either Old or New Regime. If no choice is given, employers must assume New Regime by default.

3. Can I change my tax regime during the year for TDS purposes?

Yes. You may request a regime change once during the year. However, your final choice is made when filing ITR, not at TDS stage.

4. Is HRA exemption considered while calculating TDS?

Yes. If you pay rent and submit valid rent receipts, employers must reduce the eligible HRA exemption before calculating TDS.

5. What happens if I fail to submit proof of investments?

Your employer will reverse the deductions and increase your TDS for the remaining months to adjust shortfall.

6. I changed jobs this year. How is TDS calculated?

Submit Form 12B to your new employer so they can consider your previous salary and TDS. Otherwise, you may face excess/short TDS.

7. Can I claim refund if excess TDS was deducted?

Yes. Any excess TDS can be claimed as a refund when filing your Income Tax Return.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Simple and easy to use EMI Calculator

- GST Calculator

- HRA Exemption Calculator

- Explore more tools for Finance & Tax on TaxBizmantra.com

Disclaimer

This tool provides an approximate salary TDS estimate based on Section 192 rules and the tax regime chosen. For exact tax positions, exemptions and deductions, consult your employer’s payroll team, Form 16, or a qualified tax professional.