Stop Guessing Your STP Growth — Use Our STP Calculator

A Systematic Transfer Plan (STP) helps you move money from one mutual fund to another at regular intervals — reducing market timing risk while aiming for higher, stable long-term returns.

Use this free STP Calculator to estimate how much your target fund can grow, how much you will transfer over time, and how your source fund balance reduces each month. Perfect for building low-risk, rule-based investment strategies.

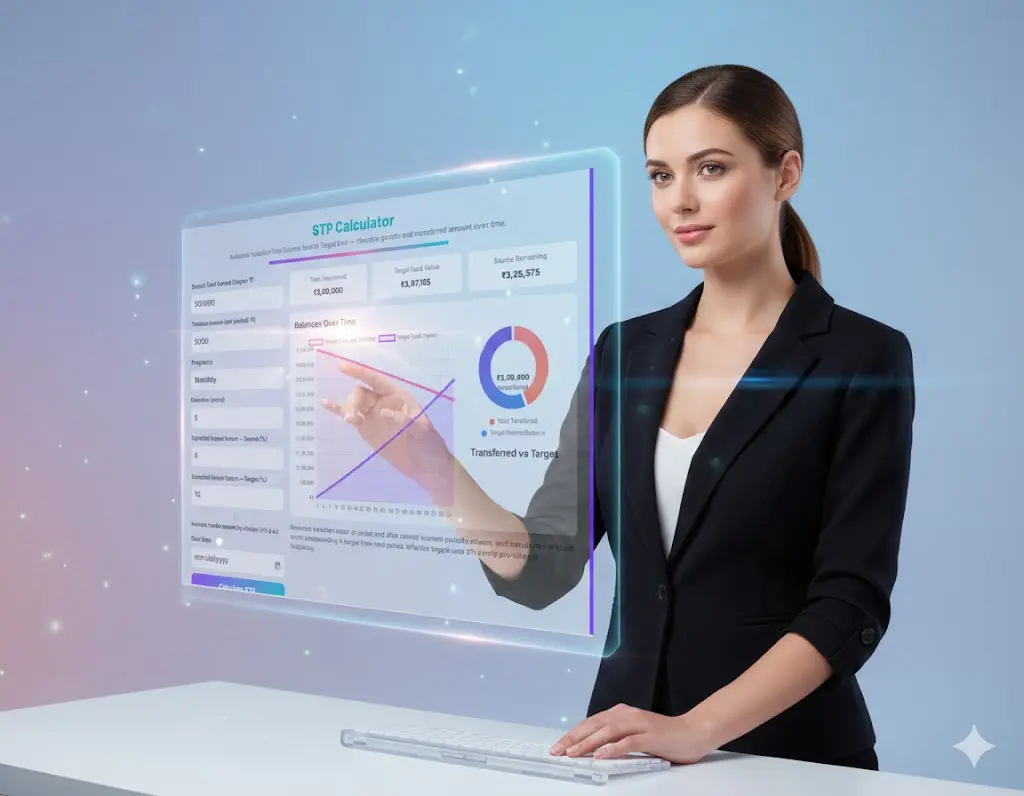

STP Calculator

Automate transfers from Source fund to Target fund — visualise growth and transferred amount over time.

Tip: STP moves money from a liquid/source fund into a growth/target fund periodically. Toggle inflation to model rising transfers over time.

Balances Over Time

What Is an STP (Systematic Transfer Plan)?

A Systematic Transfer Plan, or STP, is an automated investment strategy that allows you to transfer a fixed amount from one mutual fund (called the source fund) to another mutual fund (called the target fund) at a chosen frequency — usually weekly, monthly, or quarterly.

It works exactly like an SIP, but instead of transferring money from your bank account, the transfers happen from an existing investment corpus.

STP is commonly used when:

- You want to park a lumpsum in a low-risk fund and shift it gradually into equity.

- You want to reduce volatility and avoid investing large amounts at market highs.

- You wish to take profits from equity and move into safer debt funds automatically.

- You want to rebalance your portfolio without manually timing the market.

Why Use an STP Calculator?

Manual STP calculations can be complex because every transfer affects both funds:

- The source fund reduces with each transfer

- The target fund grows based on new units and compounding

- Returns differ between the two funds

- Duration and frequency affect final balance

This STP calculator simplifies everything by showing:

✔ Total amount transferred

✔ Growth in the target fund

✔ Remaining source balance

✔ Final target corpus

✔ Visual charts showing transfer & growth patterns

This makes your planning accurate, transparent, and data-driven.

How to Use the STP Calculator (Step-by-Step)

1. Enter Your Source Fund Corpus

This is the amount you currently hold in the initial fund (usually a debt fund).

Example: ₹5,00,000

2. Enter the Transfer Amount

This is the fixed amount that will move periodically from source → target fund.

Example: ₹5,000 per month

3. Select Transfer Frequency

Options:

- Monthly (most common)

- Weekly

- Quarterly

4. Enter Investment Duration

How long should the STP run?

Example: 5 years (60 monthly transfers)

5. Enter Expected Returns for Source & Target

- Source fund: typically 4–7% (debt/liquid fund)

- Target fund: typically 10–15% (equity fund)

6. Enable Inflation-based Transfer Increase (Optional)

Automatically increases STP amount every year — ideal for long-term plans.

7. View Your Results

The tool immediately shows:

- Total transferred amount

- Target fund value

- Source fund balance

- Cumulative growth graph

- Allocation donut chart

This helps you decide whether your STP amount or duration needs adjustment.

Example: How STP Helps Reduce Market Timing Risk

Suppose you have:

- Source Corpus: ₹5,00,000

- Monthly STP: ₹5,000

- Duration: 5 years

- Source return: 6%

- Target return: 10%

Without STP, investing ₹5 lakh in equity at once exposes you to sudden market corrections.

With STP:

- Your money gets transferred monthly

- Your risk reduces significantly

- Your target fund grows steadily

- Your final corpus can be much higher than keeping money idle in a savings or debt fund

STP works especially well in volatile markets because it helps average purchase cost and smoothens returns.

Types of STP You Can Plan Using This Calculator

1. Capital Appreciation STP

Only capital gains from source fund are transferred.

2. Fixed STP

A fixed amount moves periodically — most common.

3. Flexi STP

Transfer amount depends on market conditions or NAV levels.

This calculator supports fixed STP, which is the cleanest and easiest format for long-term planning.

Benefits of Using an STP in Mutual Funds

✔ Reduces market timing risk

Transfers happen automatically, preventing emotional decisions.

✔ Suitable for lumpsum investors

Park money in a liquid fund and gradually shift to equity.

✔ Helps manage volatility

Smoothens entry price through rupee-cost averaging.

✔ Allows healthy rebalancing

Automatically moves profits from riskier funds to safer options.

✔ Higher potential returns

Compounding in the target fund can significantly boost your long-term wealth.

Who Should Use an STP Calculator?

- Lumpsum investors wanting to enter equity gradually

- Investors shifting from debt → equity for long-term wealth creation

- People nearing retirement shifting from equity → debt

- Anyone planning a balanced investment strategy

- Investors who want a visual, precise, and transparent forecast

FAQs – STP Calculator

Q1. What is an STP in mutual funds?

An STP (Systematic Transfer Plan) automatically transfers money from one mutual fund to another at fixed intervals. It helps reduce market risk and creates disciplined investment behaviour.

Q2. How does this STP calculator work?

The calculator computes periodic transfers, source fund reduction, target fund compounding, and total growth using your selected amount, duration, and annual return rates.

Q3. Is STP better than SIP?

STP is better when you have lumpsum money. SIP is better when investing from monthly income.

Q4. Which is better — weekly or monthly STP?

Monthly STP is ideal for most investors because it balances cost, convenience, and returns.

Q5. Can STP give higher returns?

Yes — especially when you transfer from debt to equity gradually, combining low-risk parking with high-growth compounding.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Personal Loan EMI Calculator

- Home Loan EMi Calculator

- SIP Calculator

- SIP Goal Calculator

- CAGR Calculator

- XIRR Calculator

- SWP Calculator

- Free Lumpsum Investment Calculator: Maximize the Future Value

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM