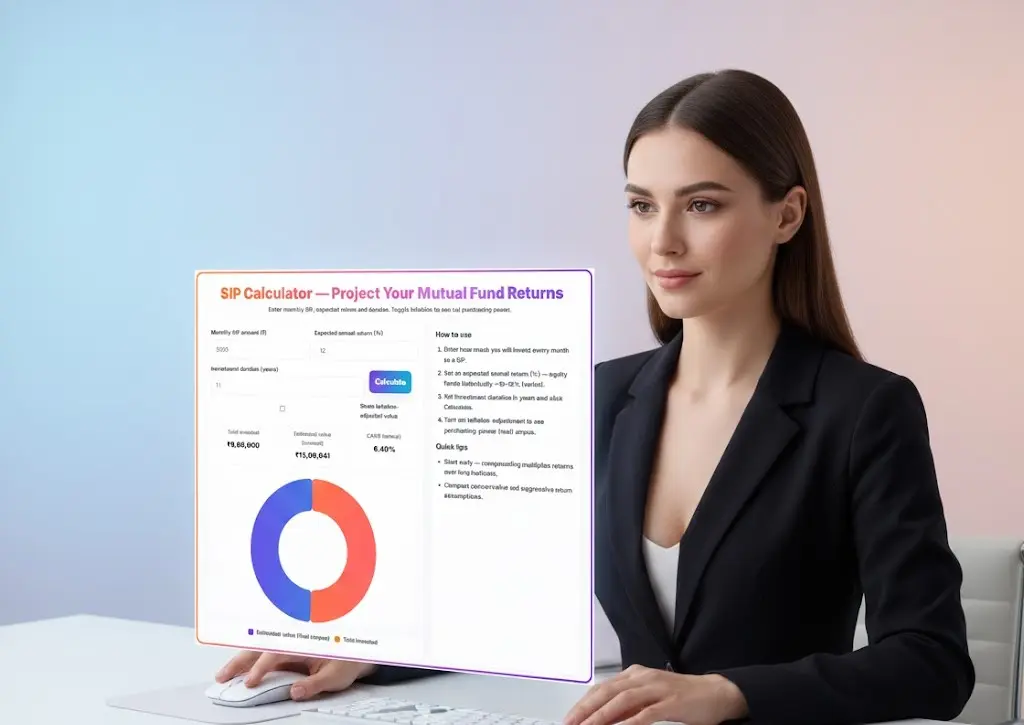

SIP Calculator – Estimate Your Future Wealth With Smart Monthly Investing

This SIP calculator gives you clear insights into your expected returns, total investment value, and inflation-adjusted corpus—empowering you to make better financial decisions.

Want more tools, please explore our tools directory overview and free tools page categories.

What Is a SIP (Systematic Investment Plan)?

A SIP is a method of investing a fixed amount in mutual funds at regular intervals—usually every month. Instead of timing the market, SIP allows you to invest gradually and benefit from rupee-cost averaging, power of compounding, and long-term growth.

In other words, A Systematic Investment Plan (SIP) is one of the simplest and most disciplined ways to build long-term wealth in mutual funds. Whether you are a beginner investor or someone planning for a financial goal like a house, child education, retirement or wealth creation, a SIP Calculator helps you instantly project how much your monthly investments can grow over time.

For example, investing ₹5,000 per month for 10–20 years can create a substantial corpus even with moderate returns. This is why SIP is one of the most popular investment options for salaried professionals and long-term wealth builders.

Why Use a SIP Calculator?

A SIP calculator helps you understand:

- How much your monthly SIP can grow

- Total amount invested over time

- Estimated future value (final corpus)

- Returns with compounding

- CAGR (annual growth rate)

- Impact of inflation on your real wealth

- How long it may take to achieve your financial goal

Without a calculator, doing these projections manually is time-consuming and inaccurate. This tool makes the process simpler, faster, and more reliable.

How the SIP Calculator Works

The SIP calculator uses the future value of monthly investments compounded monthly. The formula is:

FV = P × [(1 + r)ⁿ – 1] ÷ r

Where:

- P = Monthly SIP amount

- r = Monthly rate of return

- n = Total number of months

If you enable the inflation-adjusted mode, the calculator adjusts the return rate using:

Real return = (1 + nominal return) ÷ (1 + inflation rate) – 1

This gives a realistic picture of your purchasing power in the future.

Benefits of Using a SIP Calculator Before Investing

1. Helps You Plan Financial Goals

Whether your goal is ₹10 lakh, ₹50 lakh or ₹1 crore, the calculator shows how long it may take or how much you need to invest monthly.

2. Understand the Magic of Compounding

SIP grows significantly over time due to compounding, especially when invested for 10–20+ years.

3. Compare Different Scenarios

You can test various combinations of returns, tenure, and inflation to choose a suitable plan.

4. Stay Realistic With Expectations

Many investors overestimate returns. The calculator keeps your expectations realistic.

5. Encourages Disciplined Saving

Seeing future projections motivates consistent investing.

Example: How SIP Helps Build Wealth

Let’s say you invest ₹5,000 per month for 15 years at 12% annual return:

- Total invested: ₹9,00,000

- Estimated value: ~₹18,00,000

- Returns earned: ~₹9,00,000

- CAGR: 12%

The longer you stay invested, the bigger the compounding effect.

Inflation-Adjusted SIP Calculation (Why It Matters)

If inflation averages around 5%, your future corpus may not have the same purchasing power.

Example:

Estimated value after 15 years: ₹18,00,000

Inflation-adjusted (real) value: ₹10–11 lakh

This helps you set realistic goals instead of relying on nominal values.

Best Practices for SIP Investments

✔ Invest Early

Even a small amount invested early can create massive wealth.

✔ Stay Invested Long-Term

SIP works best when you stay invested for 10–25 years.

✔ Increase SIP Every Year

A step-up SIP helps grow wealth faster and beat inflation.

✔ Choose the Right Funds

Equity funds for long-term goals; hybrid or debt funds for short-term or conservative needs.

✔ Avoid Stopping SIP During Market Crashes

Market dips actually increase your long-term returns.

Frequently Asked Questions (FAQ)

1. Is SIP a safe investment?

SIP is a method of investing, not a type of investment. Risk depends on the mutual fund category you choose.

2. Can SIP make me a millionaire?

Yes. Even small SIPs like ₹5,000–₹10,000 can grow into crores over long durations with compounding.

3. What is the ideal SIP duration?

There is no fixed duration, but 10–20 years provides the strongest compounding benefits.

4. Can I increase or decrease my SIP anytime?

Yes, SIP amounts are fully flexible.

5. How much SIP is needed to reach ₹1 Crore?

Typically:

- ₹10,000 per month @ 12% returns → ~20 years

- ₹15,000 per month @ 12% returns → ~16 years

Use our calculator to get accurate values.

Final Thoughts

A SIP calculator is an essential tool for every investor. It not only shows how your money grows but also helps you plan your financial goals with clarity and confidence. Whether you want to build a retirement fund, plan your child’s education, or accumulate long-term wealth, SIP is one of the most reliable and disciplined investment strategies available.

Start planning smartly today—use the SIP Calculator above to see how your wealth can grow over time.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Personal Loan EMI Calculator

- Home Loan EMi Calculator

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM