Simple EMI Calculator – Calculate Your Loan EMI Instantly

Planning to take a loan for your dream home, car, or personal needs? Our free EMI calculator helps you calculate your Equated Monthly Installment (EMI) instantly and make informed borrowing decisions. Whether you’re looking for a home loan EMI calculator, car loan EMI calculator, or personal loan EMI calculator, our tool provides accurate calculations with detailed amortization schedules.

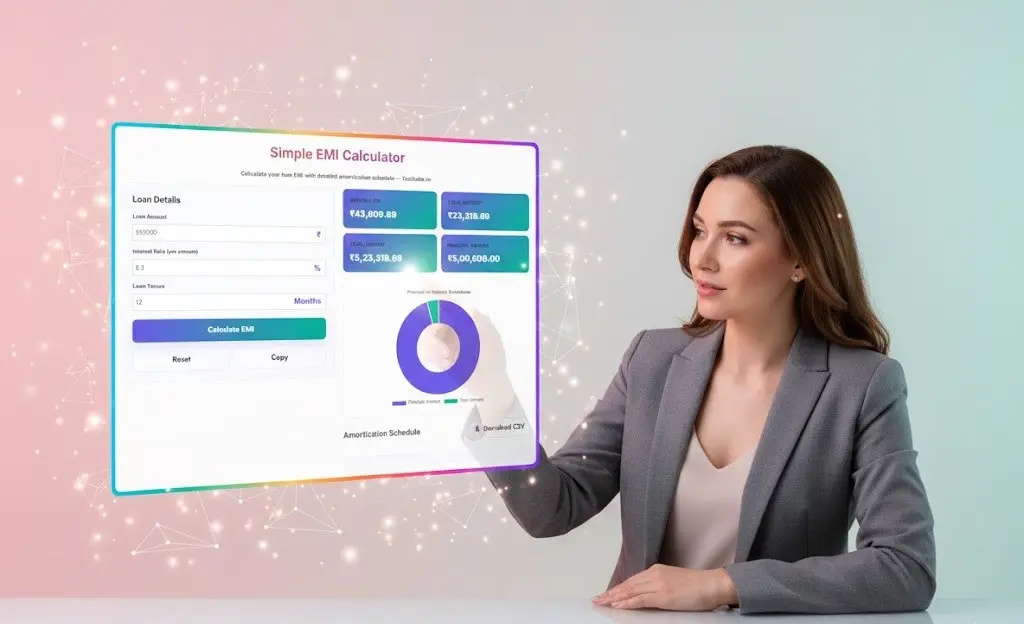

Simple EMI Calculator

Monthly EMI

Total Interest

Total Amount

Principal Amount

What is EMI and How Does It Work?

EMI stands for Equated Monthly Installment – the fixed amount you pay to your lender every month until your loan is fully repaid. When you use our loan EMI calculator, you can see exactly how much you’ll pay each month, breaking down your payment into principal and interest components.

An EMI consists of two parts:

- Principal Amount: The portion that reduces your actual loan balance

- Interest Amount: The cost of borrowing money from the lender

In the initial months, the interest component is higher, and gradually, the principal component increases. Our EMI calculation tool shows this clearly through an interactive amortization schedule.

How to Use Our EMI Calculator

Using our online EMI calculator is simple and straightforward:

- Enter Loan Amount: Input the total amount you want to borrow (minimum ₹10,000)

- Set Interest Rate: Enter the annual interest rate offered by your lender (typically 6-18% depending on loan type)

- Choose Loan Tenure: Select your repayment period in months (1-360 months or 1-30 years)

- Calculate EMI: Click the calculate button to get instant results

Our monthly EMI calculator instantly displays your monthly payment amount, total interest payable, and total repayment amount with a visual breakdown.

Key Features of Our EMI Calculator

Our Simple loan EMI calculator comes packed with features:

- Instant Calculations: Get immediate results without any delays

- Detailed Amortization Schedule: Month-by-month breakdown of principal and interest

- Visual Charts: Pie charts showing principal vs interest distribution

- Export Options: Download reports in CSV and PDF formats

- Mobile Friendly: Works seamlessly on all devices

- 100% Free: No registration or hidden charges

Understanding EMI Calculation Formula

Our EMI calculator uses the standard EMI formula:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

Where:

- P = Principal loan amount

- R = Monthly interest rate (Annual Rate/12/100)

- N = Loan tenure in months

While the formula might seem complex, our calculate EMI online tool does all the math for you instantly!

Types of Loans You Can Calculate

Our versatile Simple and Basic EMI calculator works for all types of loans and can be used by the layman as well. If you want advance features, please refer my Advance EMI Calculator- All in One EMI Calculator.

- Home Loan EMI Calculator: Calculate EMIs for housing loans, typically ranging from 15-30 years with interest rates between 8-12% per annum.

- Car Loan EMI Calculator: Determine monthly payments for vehicle loans, usually 1-7 years tenure with rates between 8-15% per annum.

- Personal Loan EMI Calculator: Plan your unsecured loan repayments, typically 1-5 years with higher interest rates of 10-18% per annum.

- Education Loan EMI Calculator: Calculate student loan repayments with varying interest rates and tenure options.

- Business Loan EMI Calculator: Plan your business financing with flexible tenure and amount options.

Why Calculate EMI Before Taking a Loan?

Using an EMI calculator before applying for a loan helps you:

- Budget Planning: Understand if the monthly payment fits your budget

- Loan Comparison: Compare offers from different lenders easily

- Interest Impact: See how interest rates affect your total payment

- Tenure Decisions: Choose optimal loan duration to minimize interest

- Financial Planning: Plan your finances better with accurate projections

Assumptions Made in EMI Calculation

Our loan EMI calculator makes the following standard assumptions:

- Fixed Interest Rate: The interest rate remains constant throughout the loan tenure

- Regular Payments: EMI is paid on the same date every month without delays

- No Prepayment: Calculations assume no partial or full prepayments (you can adjust for actual scenario)

- Simple Interest on Reducing Balance: Interest is calculated on the outstanding principal amount

- No Processing Fees: Calculator shows pure EMI without including processing fees, insurance, or other charges

- Standard Month Length: Each month is considered equal for calculation purposes

- Immediate Disbursement: Loan amount is disbursed immediately and repayment starts from next month

Note: Actual EMI may vary slightly based on lender policies, processing fees, insurance charges, and specific loan terms. Always confirm final EMI amount with your lender.

Benefits of Using ToolSuite.in EMI Calculator

- Accuracy: Precise calculations using standard banking formulas

- Speed: Get results in milliseconds

- Transparency: Clear breakdown of every component

- Privacy: All calculations happen in your browser, no data sent to servers

- Professional Reports: Generate downloadable PDF and CSV reports

- Regular Updates: Tool updated with latest calculation standards

Tips for Managing Your EMI

- Choose Shorter Tenure: Pay less total interest with shorter loan periods

- Make Prepayments: Reduce interest burden by making partial prepayments

- Compare Rates: Even 0.5% difference can save thousands over loan tenure

- Maintain Good Credit Score: Get better interest rates with scores above 750

- Avoid Over-borrowing: Borrow only what you need and can comfortably repay

Start Calculating Your EMI Now

Don’t let loan decisions stress you out. Use our free EMI calculator to plan your finances better. Whether you’re taking your first home loan or refinancing an existing one, our tool provides the clarity you need. Calculate your loan EMI today and make confident borrowing decisions!

For more financial planning tools, explore other calculators on ToolSuite.in – your trusted partner for online financial calculations.

Frequently Asked Questions (FAQ)

1. What is EMI and how is it calculated?

EMI (Equated Monthly Installment) is a fixed payment amount made by a borrower to a lender at a specified date each month. Our EMI calculator uses the formula: EMI = [P x R x (1+R)^N] / [(1+R)^N-1], where P is principal, R is monthly interest rate, and N is tenure in months. The calculator automatically computes this for you instantly.

2. How accurate is this EMI calculator?

Our loan EMI calculator is highly accurate and uses the standard banking formula accepted by all financial institutions in India. However, actual EMI may vary slightly due to processing fees, insurance charges, and rounding off by lenders. Always confirm the final EMI with your bank.

3. Can I use this calculator for home loans, car loans, and personal loans?

Yes! Our versatile EMI calculator works for all types of loans including home loans, car loans, personal loans, education loans, and business loans. Simply enter your loan amount, interest rate, and tenure to get accurate EMI calculations for any loan type.

4. What is the difference between reducing balance and flat interest rate?

Reducing balance interest is calculated on the outstanding loan amount, which decreases with each EMI payment. Flat rate is calculated on the entire principal throughout the tenure. Our calculate EMI online tool uses the reducing balance method, which is the standard practice in India and more beneficial for borrowers.

5. How does loan tenure affect my EMI?

Longer tenure reduces your monthly EMI but increases total interest paid. Shorter tenure increases EMI but saves significant interest. Use our EMI calculator to compare different tenures and find the balance between affordable monthly payments and minimal interest cost.

6. Can I download my EMI calculation report?

Yes! Our EMI calculator allows you to download detailed amortization schedules in both PDF and CSV formats. These reports include month-by-month breakdowns of principal, interest, and outstanding balance, perfect for financial planning and loan comparisons.

7. What happens if I prepay part of my loan?

Prepaying reduces your outstanding principal, which can either reduce your EMI amount or shorten your loan tenure. While our basic calculator doesn’t account for prepayments, you can recalculate with the reduced principal amount to see the impact. Most banks allow prepayment with minimal or no charges.

8. Why is my actual bank EMI slightly different from the calculator?

Small differences can occur due to processing fees, loan insurance, rounding off practices, exact number of days in months, or GST on interest. Our loan EMI calculator provides the base EMI calculation. Always check your loan agreement for the exact amount including all charges.

9. Is it better to choose a lower EMI or shorter tenure?

It depends on your financial situation. Lower EMI (longer tenure) is better if you want comfortable monthly payments, but you’ll pay more interest overall. Shorter tenure (higher EMI) saves significant interest if you can afford higher monthly payments. Use our calculator to compare both scenarios.

10. Do I need to register or pay to use this EMI calculator?

No! Our EMI calculator is completely free to use with no registration required. Calculate unlimited EMIs, download reports, and access all features without any charges. ToolSuite.in is committed to providing free financial tools for everyone.

11. How often should I recalculate my EMI?

Recalculate whenever interest rates change, if you’re considering refinancing, before making prepayments, or when comparing loan offers from different banks. Our calculate EMI online tool is always available for instant calculations whenever you need them.

12. What credit score do I need for better EMI rates?

Banks typically offer the best interest rates (and thus lower EMIs) to borrowers with credit scores above 750. A higher credit score can reduce your interest rate by 1-2%, which can save thousands over the loan tenure. Use our calculator to see how rate differences impact your EMI.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM