Personal Loan EMI Calculator — Plan Smarter, Borrow Better

Estimate your monthly EMI, total interest and complete repayment schedule instantly with our Personal Loan EMI Calculator. Make informed borrowing decisions with a clear, accurate loan breakdown tailored to your exact numbers.

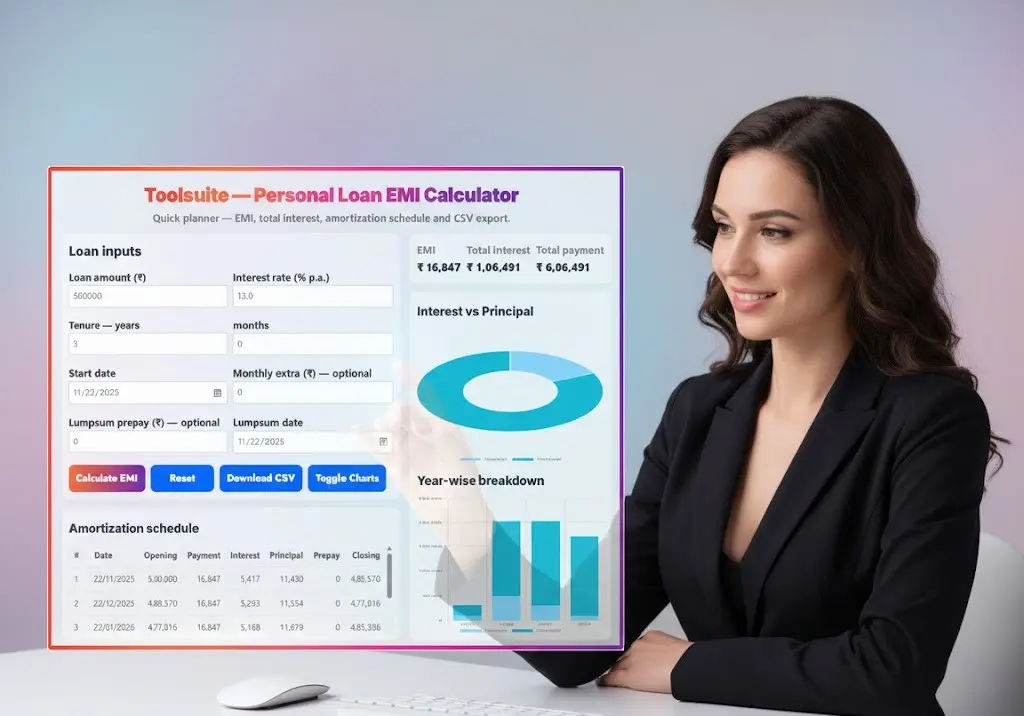

Toolsuite — Personal Loan EMI Calculator

Quick planner — EMI, total interest, amortization schedule and CSV export.

Loan inputs

Amortization schedule

| # | Date | Opening | Payment | Interest | Principal | Prepay | Closing |

|---|

Rounded to nearest rupee. Export CSV for exact values.

What Is a Personal Loan?

A personal loan is a flexible, unsecured loan offered by banks and NBFCs for almost any need — medical emergencies, home repairs, travel, weddings, education, debt consolidation or personal purchases.

Because no collateral is required, personal loans often come with slightly higher interest rates but quick approval and minimal documentation. Understanding your EMI before applying helps you borrow confidently and avoid expensive surprises later.

How Personal Loan EMI Works (Simple + Technical Explained)

A personal loan EMI (Equated Monthly Instalment) is the fixed amount you repay every month. Each EMI includes:

- Interest: The monthly cost of borrowing

- Principal: The amount that reduces your outstanding balance

At the beginning of your loan, a major portion of your EMI goes toward interest. Over time, as the principal reduces, the interest component falls, and more of your EMI goes towards repayment.

EMI Formula

Our calculator uses the exact reducing-balance EMI formula used by Indian banks: EMI=P×r(1+r)n(1+r)n−1\text{EMI} = P \times \frac{r(1+r)^n}{(1+r)^n – 1}EMI=P×(1+r)n−1r(1+r)n

Where:

- P = Loan amount

- r = Monthly interest rate (Annual Rate ÷ 12 ÷ 100)

- n = Tenure in months

This ensures your EMI calculation stays accurate and bank-compliant.

How to Use the Personal Loan EMI Calculator

Follow this quick guide for the best results:

Step 1: Enter the Loan Amount

Enter how much you want to borrow — example: ₹3,00,000.

Step 2: Add the Interest Rate

Use the exact rate given by your lender or try 1–2 different rates for comparison (example: 12% p.a).

Step 3: Choose Loan Tenure

Select your preferred duration in years and months — shorter tenure = higher EMI but lower interest.

Step 4: Set EMI Start Date

This ensures the amortization table shows accurate dates.

Step 5: Add Prepayment Options (Optional)

- Monthly extra EMI (example: +₹1,000 every month)

- One-time lumpsum payment (example: ₹25,000 in month 10)

This helps you see how early repayment reduces total interest and tenure.

Step 6: Hit “Calculate EMI”

Instantly view:

- Monthly EMI

- Total interest payable

- Total repayment

- Interest vs Principal chart

- Year-wise repayment

- Full amortization schedule

- Downloadable CSV

Understanding the Inputs: What Each Field Means

👉 Loan Amount

The principal amount you want to borrow. Higher loan = higher EMI & interest.

👉 Interest Rate (Annual %)

The percentage charged by the lender. Personal loans typically range from 10% to 24%, depending on:

- Credit score

- Income stability

- Work profile

- Employer category

- Existing debts

👉 Loan Tenure

Total duration of repayment. Usually 12–60 months.

- Shorter tenure: High EMI, lowest interest

- Longer tenure: Lower EMI, higher interest

👉 EMI Start Date

Used to calculate month-wise repayment and amortization.

👉 Monthly Extra EMI (Optional)

Small monthly extras reduce your total interest dramatically.

👉 Lumpsum Prepayment (Optional)

One-time payments reduce outstanding balance and shorten tenure.

⭐ Why Prepayment Matters (Huge Savings!)

Prepaying even small amounts early can save a massive amount of interest. Example:

- Loan: ₹3,00,000

- Interest: 14%

- Tenure: 36 months

If you add ₹1,000 extra every month, you may save ₹10,000–₹15,000 in interest and close the loan months early.

Our calculator shows this impact clearly.

Benefits of Using This Calculator

✔ Crystal-clear EMI estimate

Instant EMI + interest calculations based on real bank formulas.

✔ Year-wise breakup for financial clarity

Helps you understand how interest reduces every year.

✔ Amortization table with dates

Full month-by-month repayment schedule.

✔ Prepayment simulation

Check how extra payments affect your loan.

✔ Download results as CSV

Useful for tax planning, budgeting and comparing loan offers.

✔ Perfect for salary earners and self-employed

Helps plan future EMIs and financial commitments.

Important Tips Before Taking a Personal Loan

🔹 Check full cost of borrowing (APR/EIR)

Interest + processing fee + any insurance product lenders push.

🔹 Choose EMI within 30–40% of your net income

Safe affordability zone.

🔹 Avoid long tenures unless necessary

They increase interest drastically.

🔹 Maintain a strong credit score (>750)

You’ll get a lower rate and faster approval.

🔹 Avoid unnecessary insurance add-ons

Not compulsory unless required by lender.

🔹 Make part prepayment whenever possible

Even ₹5,000–₹10,000 helps shorten tenure.

FAQs — Personal Loan EMI Calculator

1. What is EMI in a personal loan?

EMI is the monthly repayment combining principal + interest.

2. How accurate is this calculator?

It uses the same formula and logic followed by Indian banks & NBFCs.

3. What is the ideal tenure for a personal loan?

24–48 months is optimal for balancing EMI and interest.

4. Does prepayment reduce EMI or tenure?

Most banks reduce tenure by default; EMI reduction is available on request.

5. Can I download the amortization schedule?

Yes, you can download detailed repayment data as a CSV.

6. Is my data stored?

No — all calculations happen in your browser.

7. Do personal loans have floating rates?

Most are fixed, but some NBFCs may offer floating rates.

8. How does credit score impact interest rate?

Higher credit score = lower interest + faster approval.

9. Are processing fees included?

Usually not; they are paid upfront. Our tool assumes fees are excluded unless added manually.

10. Can I use this for top-up loans?

Yes — simply enter the top-up amount and your lender’s rate.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Home Loan EMi Calculator

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM