Mutual Fund CAGR Calculator: Find Your True Annual Growth Rate

Quickly cut through the noise and calculate the true, normalized annual return on your Mutual Fund investments. Our free CAGR calculator makes evaluating performance simple, clear, and instant.

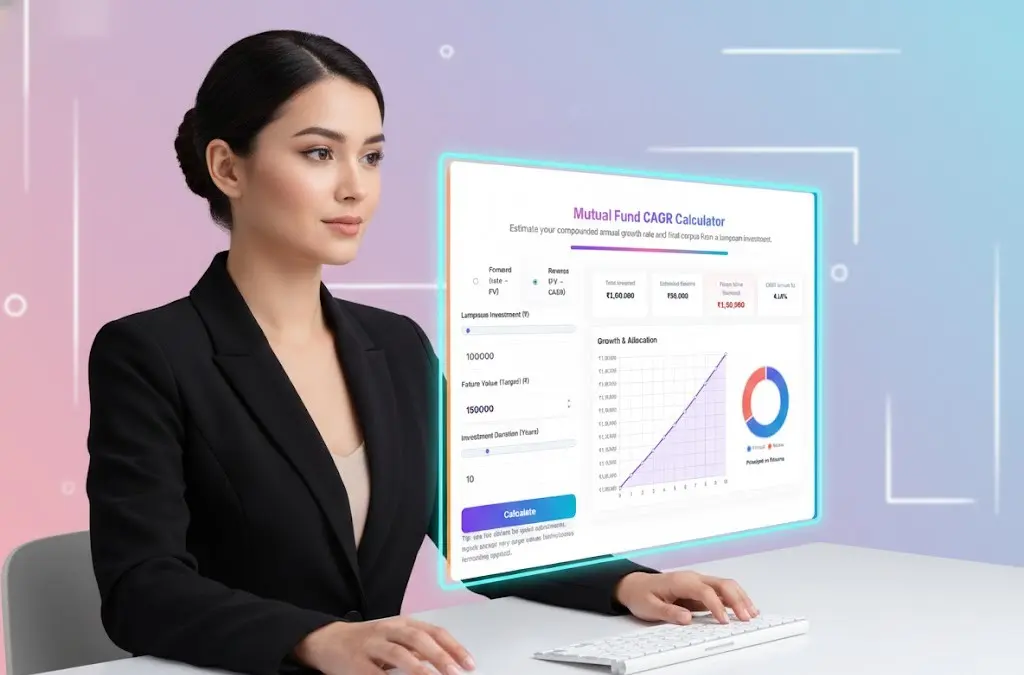

Mutual Fund CAGR Calculator

Estimate your compounded annual growth rate and final corpus from a lumpsum investment.

Tip: use the sliders for quick adjustments. Inputs accept very large values (lakhs/crores formatting applied).

Growth & Allocation

What is CAGR (Compound Annual Growth Rate)?

The Compound Annual Growth Rate (CAGR) is the average annual growth rate of an investment over a specified period longer than one year, assuming the profits are reinvested each year. It is one of the most widely used and effective metrics for smoothing out volatile returns and finding a single, representative growth rate that spans the entire investment horizon.

CAGR is particularly useful for assessing the performance of Mutual Funds and comparing them against benchmarks (like the Nifty 50 or Sensex) or against other funds. It answers the fundamental question: “If the growth had been steady and compounded annually, what rate would have delivered the final value?”

The CAGR Formula Explained

The CAGR formula is simple yet powerful. It requires only three inputs:$$\text{CAGR} = \left(\frac{\text{Ending Value}}{\text{Beginning Value}}\right)^{\left(\frac{1}{\text{Number of Years}}\right)} – 1$$

Components of the Formula:

- Ending Value: The final corpus value of your Mutual Fund investment on the date of calculation or redemption.

- Beginning Value: The initial lumpsum investment amount.

- Number of Years: The exact duration of the investment period (expressed in years).

Our Mutual Fund CAGR Calculator handles the complex exponentiation and calculation automatically, giving you the result in a clear percentage format.

Why CAGR is Important for Mutual Fund Investors

While XIRR is necessary for irregular deposits (SIPs), CAGR is the benchmark for institutional and comparative performance analysis.

1. Standardized Comparison

CAGR is the most effective way to compare two different mutual funds or investment assets. If Fund A grew from $10,000 to $15,000 in three years and Fund B grew from $5,000 to $7,000 in two years, you cannot compare absolute returns. Calculating the CAGR for both gives you an apples-to-apples annualized growth rate to make an objective decision.

2. Eliminating Volatility

Stock markets and Mutual Fund returns are rarely straight lines. One year might see a 30% gain, and the next a 10% loss. CAGR provides a single, steady rate, stripping away the year-to-year volatility to show the fundamental performance trend.

3. Setting Realistic Expectations

If a fund generated 15% CAGR over the last five years, it allows you to set more realistic expectations for its future performance, assuming similar market conditions.

Calculating CAGR on Mutual Fund Lumpsum Investment

CAGR is ideally suited for calculating the returns on a lumpsum investment where a single amount was invested at the start and redeemed or valued at the end.

How to Use Our Calculator for Lumpsum:

- Enter the initial investment amount (the

Beginning Value). - Enter the current or final value of your investment (the

Ending Value). - Enter the investment duration in years. (You can also enter start and end dates, and the tool will calculate the duration).

Instantly calculate the growth rate and gain clarity on how well your Mutual Fund portfolio has performed over the long term.

Frequently Asked Questions (FAQ)

Q1: What is the main difference between CAGR and XIRR for investments?

CAGR (Compound Annual Growth Rate) is best used for lumpsum investment returns, calculating the growth rate between a single starting value and a single ending value. XIRR is designed for irregular cash flows (like SIPs or partial withdrawals) as it accounts for the exact date of every transaction. If you made only one deposit, CAGR is sufficient. If you made multiple, XIRR is more accurate.

Q2: Is CAGR a good metric for calculating SIP returns?

No, CAGR is not suitable for SIP returns. Since a SIP involves multiple deposits on different dates, you must use a metric that accounts for the time value of each individual installment. For SIPs, the XIRR calculator is the industry standard for determining the most accurate Compound Annual Growth Rate for the portfolio.

Q3: Why is it called the ‘Annual’ Growth Rate?

The term ‘Annual’ means the return is normalized to a one-year period. Even if your investment period is 5 years, the CAGR formula calculates the single, constant rate that, if applied and compounded annually over those 5 years, would result in the observed final value. This allows for a fair comparison of Mutual Fund returns across different time frames.

Q4: Can I use this calculator to project future returns?

The Mutual Fund CAGR Calculator is a historical tool—it tells you how your investment has performed. While you can use the historical growth rate as a basis for projection (e.g., using a SIP calculator that requires an expected return), remember that past performance calculated by CAGR is not a guarantee of future Mutual Fund returns.

Q5: Does the CAGR calculation include investment expenses or fees?

Yes, indirectly. When you calculate the CAGR using the Ending Value of your Mutual Fund investment, that value is already net of all fund expenses (like the Expense Ratio) because these fees are deducted before the Net Asset Value (NAV) is calculated. Therefore, the resulting Compound Annual Growth Rate is your true, post-expense return.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Personal Loan EMI Calculator

- Home Loan EMi Calculator

- SIP Calculator

- SIP Goal Calculator

- Free Lumpsum Investment Calculator: Maximize the Future Value

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM