Income Tax Rebate Calculator (Section 87A) — New Regime

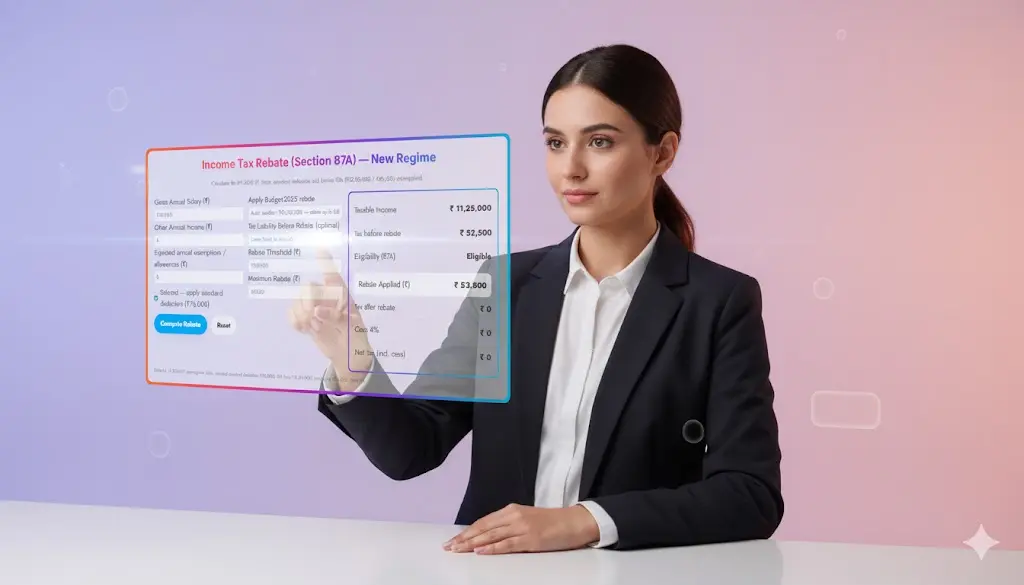

Calculate your income tax rebate instantly under Section 87A using our simple online income tax rebate calculator. This tool helps you check whether you qualify for the new-regime rebate and estimate your net tax payable for AY 2026-27 (FY 2025-26).

Want more tools, please explore our tools directory overview and free tools page categories.

Income Tax Rebate (Section 87A) — New Regime

What is Section 87A?

Section 87A of the Income Tax Act offers a tax rebate to resident individuals whose taxable income does not exceed the prescribed limit. This rebate reduces the tax liability to zero, making it one of the most important tax relief provisions for low- and middle-income taxpayers.

Under the new tax regime, the rebate is more beneficial because the threshold is higher, and the tax structure is simpler. From Finance Act 2025, the rebate provisions apply with updated limits and tax slabs for AY 2026-27.

Section 87A Rebate — AY 2026-27 (FY 2025-26)

Under the New Tax Regime (default regime):

- If taxable income ≤ ₹12,00,000, you get a full rebate

- Maximum rebate allowed = ₹60,000

- Net tax payable becomes ₹0

This rebate applies after computing tax using the new-regime slab rates.

New Tax Regime Slabs for AY 2026-27 (FY 2025-26)

The slab rates applicable for calculating the tax before applying 87A rebate are:

| Taxable Income (₹) | Tax Rate |

|---|---|

| 0 – 4,00,000 | 0% |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| Above 16,00,000 | 30% |

Standard Deduction (Salaried & Pensioners): ₹75,000 (Auto-applied inside the calculator)

Who Can Claim Section 87A Rebate?

You can claim the rebate if:

- You are a resident individual (not applicable to NRIs).

- Your taxable income does not exceed ₹12,00,000 under the new regime.

- You have computed tax after applying standard deduction and exemptions allowed under the new regime.

- You do not have special-rate income (e.g., Section 111A STCG, lottery winnings, horse race income) counted toward eligibility unless specifically excluded.

The rebate is applied after tax computation but before adding 4% health & education cess.

How 87A Rebate Works (Simple Explanation)

- Compute taxable income = (Gross Income – Standard Deduction – Exemptions)

- Apply new-regime slab rates to calculate the tax before rebate

- If taxable income ≤ ₹12,00,000, rebate applies

- Rebate amount = Lower of:

- Tax calculated, or

- ₹60,000

- Apply 4% cess

- Final tax payable is shown

Our 87A Rebate Calculator automates all these steps.

Example: How Section 87A Rebate Applies

Example 1 — Eligible for Rebate

- Gross Income: ₹14,00,000

- Standard Deduction: ₹75,000

- Taxable Income: ₹13,25,000

- After subtracting HRA exempt / allowances: Taxable income = ₹11,75,000

Since taxable income ≤ ₹12,00,000

➡ You get full rebate up to ₹60,000

➡ Net tax after rebate = ₹0 + cess = ₹0

Example 2 — Not Eligible for Rebate

- Taxable Income: ₹12,50,000

➡ Income exceeds threshold

➡ No rebate

➡ Full slab-based tax + cess applies

How to Use the Section 87A Rebate Calculator

Follow these simple steps:

- Enter salary income and other income

- Enter any exemptions/allowances allowed under the new regime (e.g., HRA exempt if eligible)

- Standard deduction is auto-applied

- Calculator computes taxable income

- It applies new-regime slabs to compute tax before rebate

- If eligible, rebate up to ₹60,000 auto-applies

- Final tax payable including 4% cess is displayed

Ideal for salaried individuals, freelancers, pensioners, and first-time tax filers.

Benefits of Using This 87A Rebate Calculator

- 100% updated for AY 2026-27

- Auto-calculates taxable income

- Auto-applies standard deduction

- Calculates correct slab-based tax

- Auto-applies rebate eligibility

- Separates special-rate income to avoid incorrect eligibility

- Mobile-friendly

- Clear breakdown of taxable income, rebate applied, and net tax payable

Frequently Asked Questions (FAQs)

1. What is Section 87A rebate?

It is a tax rebate given to resident individuals with taxable income up to the specified limit. Under the new regime, it provides full tax relief up to ₹60,000.

2. Is 87A available under both regimes?

Yes, but the threshold and rebate differ. The new regime has a higher limit (₹12,00,000), making it more beneficial.

3. Does 87A apply before or after cess?

It applies before adding 4% health & education cess.

4. Can NRIs claim Section 87A?

No, only resident individuals can claim the rebate.

5. Does special-rate income affect rebate eligibility?

Yes. If special-rate income increases total taxable income beyond the threshold, the rebate may not apply.

6. Is the rebate automatic?

Yes, if you file taxes using the new regime and taxable income fits within the limit.

7. What is the maximum rebate amount for AY 2026-27?

Maximum rebate available = ₹60,000.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Simple and easy to use EMI Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity calculator

- Explore more tools for Finance & Tax on TaxBizmantra.com