Advance Tax Interest Calculator (Section 234C) — Shortfall Interest Online

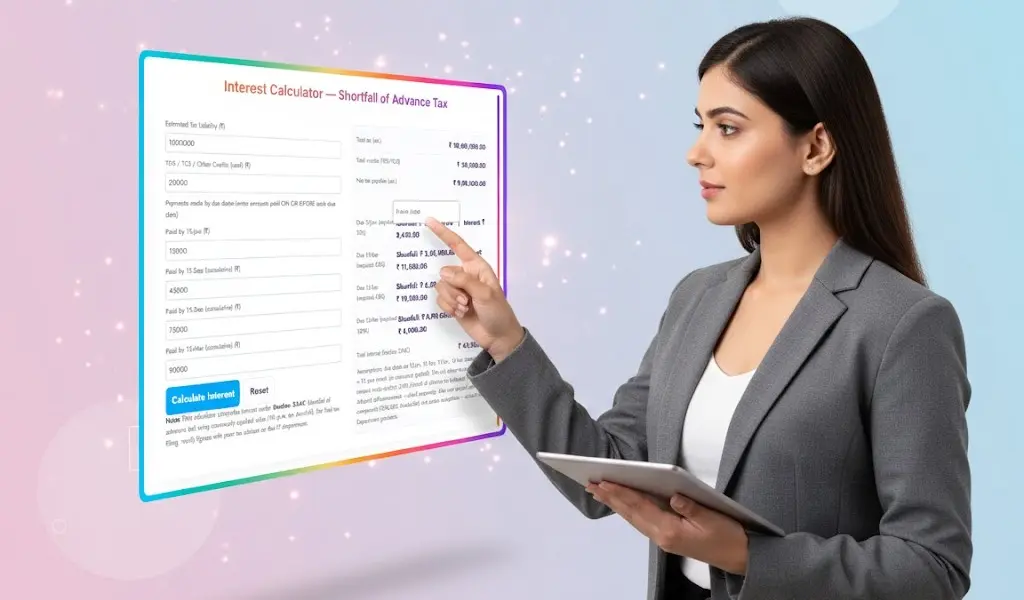

Use this Advance Tax Interest Calculator to quickly compute Section 234C interest, advance tax shortfall, and instalment-wise interest payable as per Indian income tax rules.

Want more tools, please explore our tools directory overview and free tools page categories.

Interest Calculator — Shortfall of Advance Tax

Note: This calculator computes interest under Section 234C (shortfall of advance tax) using commonly applied rules (1% p.m. on shortfall). For final tax filing, verify figures with your tax advisor or the I-T department.

Assumptions: due dates are 15 Jun, 15 Sep, 15 Dec, 15 Mar; interest rate = 1% per month (as commonly applied). This tool does not compute interest under section 234B (default of advance tax balance) or interest on delayed self-assessment — check separately. Also note special provisos for companies (12%/36% thresholds) and certain exceptions — consult the IT Department guidance.

What Is Advance Tax?

Advance tax is a mandatory system where taxpayers must pay their estimated total tax during the financial year instead of at year-end. If your net tax liability after TDS/TCS exceeds ₹10,000, you must pay advance tax in instalments. Failure to pay the correct instalment leads to a shortfall of advance tax, triggering Section 234C interest.

Advance Tax Due Dates India (Required for Section 234C Interest Calculator)

To avoid interest, the Income Tax Department requires taxpayers to pay advance tax as follows:

| Due Date | Minimum Cumulative Advance Tax Required |

|---|---|

| 15 June | 15% of total tax liability |

| 15 September | 45% |

| 15 December | 75% |

| 15 March | 100% |

Users under Presumptive Taxation (44AD/44ADA) must pay 100% by 15 March.

Missing these instalments causes 234C interest.

Section 234C Interest Calculator — How 234C Interest Is Calculated

Section 234C charges interest for deferment of advance tax instalments. Interest applies when you fail to pay the required instalment on time.

Interest Rate Under Section 234C

- 1% per month (or part of a month)

- Calculated on the shortfall amount for each instalment

Interest Period Used by All Major Calculators

- June instalment shortfall → 1% × 3 months

- September shortfall → 1% × 3 months

- December shortfall → 1% × 3 months

- March shortfall → 1% × 1 month

Shortfall Formula Used in This Calculator

Shortfall = Required Instalment – (Advance Tax Paid by That Date – TDS/TCS Credits)

Interest = Shortfall × 1% × Months Applicable

Our Section 234C Calculator automatically applies these rules instalment-wise.

Who Must Pay 234C Interest?

You must pay interest under Section 234C if:

- Your advance tax instalments were short or delayed

- TDS deducted by employer was insufficient

- Your freelance/professional income increased suddenly

- You earned business income without advance tax planning

Who Is NOT Liable for 234C Interest?

No interest under 234C if shortfall occurred due to:

- Capital gains

- Lottery or speculative incomes

- Dividend income (excluding deemed dividend)

- Unexpected “Income from Other Sources”

Tax must still be paid by 31 March to avoid 234B interest.

Why Use This Advance Tax Interest Calculator

This calculator helps you:

- Calculate instalment-wise 234C interest instantly

- Adjust shortfall after reducing TDS/TCS correctly

- Understand interest payable for each due date

- Avoid penalties and year-end burden

- Plan next year’s advance tax more accurately

It is designed using the actual provisions of Section 234C and follows the same method used by major tax platforms.

FAQs — Advance Tax, Section 234C, Shortfall & Interest Rules

1. What is advance tax?

Advance tax is tax paid during the financial year in instalments based on estimated annual income. It prevents a large lump-sum tax payment at year-end.

2. Who is required to pay advance tax?

Any taxpayer (individual, NRI, business, company, professional) whose net tax liability exceeds ₹10,000 after TDS/TCS.

3. What happens if I do not pay advance tax?

You must pay interest under Section 234B and Section 234C, depending on whether you missed instalments or paid late.

4. What is Section 234C?

Section 234C charges interest for delayed or insufficient advance tax instalments. It is calculated instalment-wise.

5. What is the 234C interest rate?

Interest is 1% per month or part of a month on the shortfall amount.

6. Is 234C interest applicable to salaried employees?

Yes, if TDS is not sufficient to cover total tax liability, salaried taxpayers must pay advance tax. If they don’t, 234C applies.

7. Do capital gains attract 234C interest?

No, capital gains are exempt from 234C, provided tax on such gains is paid in the next instalment or by 31 March.

8. What is the difference between Section 234B and 234C?

- 234C → Interest for missing instalment dates

- 234B → Interest if advance tax paid is less than 90% of total tax liability by 31 March

9. Is advance tax required for presumptive taxation (44AD/44ADA)?

Yes, but only one instalment: 100% of tax must be paid by 15 March.

10. How does this calculator compute 234C interest?

It uses government-specified percentages, instalment due dates, and 1% monthly interest to compute:

- Instalment-wise shortfall

- Interest for June, September, December, and March

- Total 234C interest payable

For detailed tax and finance explanations, case studies, and practical guides, explore our in-depth articles on TaxBizmantra.com.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Simple and easy to use EMI Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

Disclaimer

This calculator provides approximate interest under Section 234C based on standard advance tax rules. Please verify final figures with a tax professional or the Income Tax Department.