EPF Contribution Calculator — Calculate EPF, EPS & Employer–Employee Split

A professional-grade EPF Contribution Calculator to compute monthly and annual EPF, EPS, and employer–employee split as per the Employees’ Provident Fund & Miscellaneous Provisions Act, 1952 (EPF Act).

Want more tools, please explore our tools directory overview and free tools page categories.

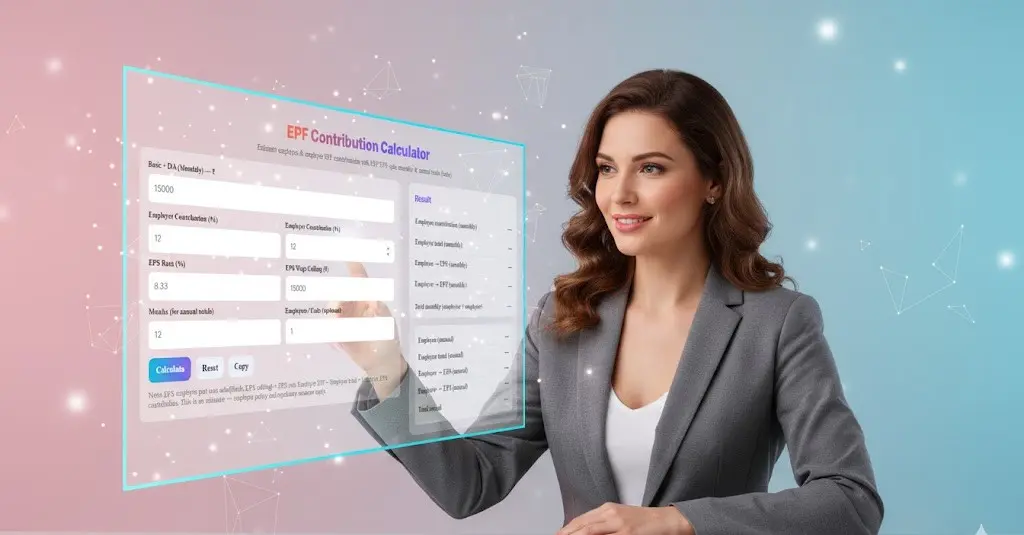

EPF Contribution Calculator

Estimate employee & employer EPF contributions with EPF/EPS split, monthly & annual totals (India).

EPF Contribution Rules Under the EPF Act

The Employees’ Provident Fund (EPF) is governed by the EPF & MP Act, 1952, designed to provide long-term retirement security to salaried individuals. As per Section 6 of the EPF Act, both employee and employer must contribute a defined percentage of the employee’s Basic Wages + Dearness Allowance (DA).

How to Use This EPF Contribution Calculator

Using the EPF Contribution Calculator is simple and requires only your monthly Basic Salary + Dearness Allowance (DA). Enter your Basic + DA amount, and the calculator automatically applies the statutory EPF and EPS contribution rates as per Section 6 of the EPF Act. It computes the employee EPF, employer EPF, employer EPS, and the final total monthly and annual PF contribution. The tool also incorporates the mandatory EPS wage ceiling of ₹15,000 to ensure accurate pension calculations. Once the values are entered, the calculator instantly displays a clear, compliant breakdown of contributions, helping employees and employers understand their provident fund obligations with 100% accuracy.

How to calculate EPF contribution as per the EPF Act (India)

This calculator follows statutory rules set out in Section 6 (contribution rates), Schedule I (PF calculation base), the Employees’ Pension Scheme (EPS), 1995, and the statutory wage ceiling of ₹15,000. The standard contribution rates applied are:

- Employee: 12% of Basic + DA.

- Employer: 12% of Basic + DA, which is split between EPS and EPF as described below.

The employer’s 12% is allocated so that 8.33% of eligible wages goes to EPS (subject to the ₹15,000 ceiling) and the remainder flows to the employer’s EPF portion.

EPF employer–employee split (allocation of employer contribution)

- Employer → EPS (pension): 8.33% of min(Basic + DA, ₹15,000). Maximum employer EPS per month = ₹1,250.

- Employer → EPF: Employer total contribution (12% of Basic + DA) minus the EPS portion.

This split determines pensionable service (EPS) and the provident-fund accumulation (EPF).

EPF calculation formula (monthly basis)

- Employee EPF = (Basic + DA) × 12%.

- Employer EPS (pension) = min(Basic + DA, ₹15,000) × 8.33%.

- Employer EPF = (Basic + DA) × 12% − Employer EPS.

- Total monthly PF = Employee EPF + Employer EPF.

Multiply monthly totals by 12 to obtain annual figures.

PF and EPS contribution — worked example

Assume Basic + DA = ₹22,000 and standard contribution rates of 12%.

- Employee EPF: 12% × ₹22,000 = ₹2,640.

- Employer EPS: 8.33% × ₹15,000 (wage ceiling) = ₹1,250.

- Employer EPF: Employer total (12% × ₹22,000 = ₹2,640) − EPS (₹1,250) = ₹1,390.

- Total monthly PF: ₹2,640 + ₹1,390 = ₹4,030.

- Total annual PF: ₹4,030 × 12 = ₹48,360.

This example follows EPFO rules and shows the EPF/EPS allocation clearly.

EPF pension eligibility and contribution rules (EPS)

- Minimum service for pension: Generally 10 years of contributory service for pension entitlement under EPS.

- Normal pension age: 58 years (reduced/early pension options subject to scheme rules).

- EPS contribution rule: Always 8.33% of eligible wages; capped at ₹1,250/month (unless higher-pension option is formally chosen).

Regulatory and compliance guidelines (EPFO)

- UAN (Universal Account Number): Must be activated for PF portability and tracking.

- EPF interest rate: Declared annually by EPFO and applied to PF balances.

- Withdrawals: Partial withdrawals allowed for specified purposes (house purchase, marriage, medical, education) per EPF Scheme provisions.

- Tax treatment: Employee EPF contributions qualify for deduction under Section 80C. EPF interest and maturity proceeds are tax-exempt if conditions (e.g., 5 years continuous service) are met; premature withdrawal may attract tax.

- Higher pension option: Available under prescribed conditions; requires formal election and may change contribution/pension treatment.

Key EPF wage limit & coverage rules

- Statutory wage ceiling: ₹15,000 per month — employees with Basic + DA up to this amount are mandatorily covered.

- Higher salary employees: May either continue PF on full salary (if employer permits) or limit PF to the statutory ₹15,000 ceiling; higher pension options may apply.

- Employer EPS limit: EPS is capped at ₹1,250/month (8.33% of ₹15,000) unless higher pension option is exercised.

- Tax implications: Employee contributions are eligible for Section 80C; interest and maturity treatment depends on service length and applicable tax rules.

Frequently asked questions (FAQs)

1. What is EPF and how does it work?

EPF is a mandatory retirement savings scheme in which the employee contributes a percentage of Basic + DA and the employer contributes a matching percentage. Contributions earn interest and accumulate in an EPF account linked to the employee’s UAN.

2. What is the employer–employee split for EPF?

Employee contributes 12% of Basic + DA. Employer contributes 12%, of which 8.33% (subject to the ₹15,000 ceiling) goes to EPS and the remainder goes to the employer’s EPF portion.

3. How is EPF calculated under the EPF Act?

Employee EPF = 12% of Basic + DA. Employer EPS = 8.33% of min(Basic + DA, ₹15,000). Employer EPF = 12% of Basic + DA − EPS. Total monthly PF = Employee EPF + Employer EPF.

4. What is the EPS wage ceiling?

EPS contributions are calculated only on wages up to ₹15,000 per month; the maximum employer EPS contribution is ₹1,250 per month.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Simple and easy to use EMI Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- Explore more tools for Finance & Tax on TaxBizmantra.com