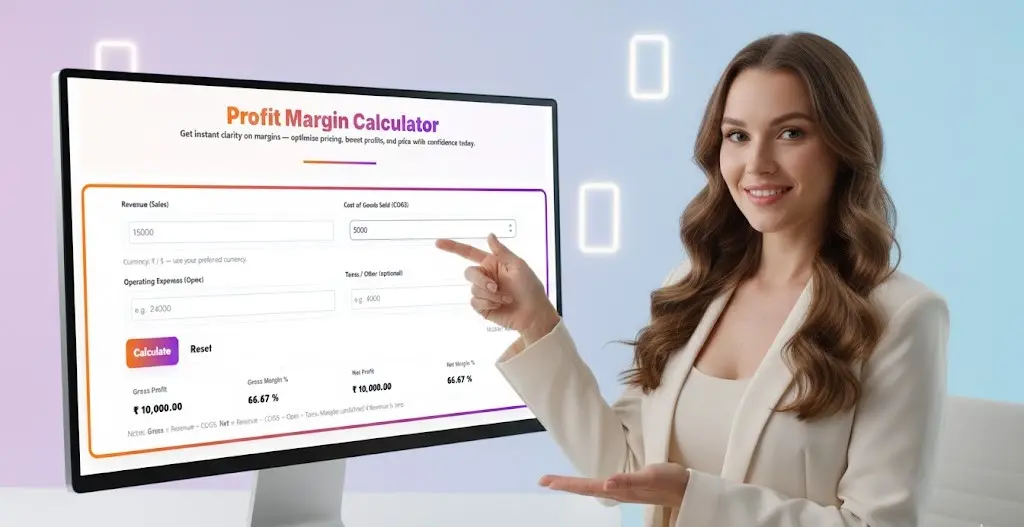

Profit Margin Calculator: Calculate Your Business Profitability Instantly

Get Instant Clarity on Margins — Optimize Pricing, Boost Profits, and Price with Confidence Today. Understanding your profit margins is essential for making informed business decisions and ensuring long-term financial success. Our free profit margin calculator helps you quickly determine gross profit, net profit, gross margin percentage, and net margin percentage with accuracy and ease.

Profit Margin Calculator

Get instant clarity on margins — optimize pricing, boost profits, and price with confidence today.

Next step: Improve your profit margin in practice

If you generate invoices regularly or manage GST for a business,

profit margins often leak due to manual billing errors, missed stock tracking, and delayed collections.

Many small businesses reduce these issues by using invoice and accounting software like Vyapar to manage billing, inventory, and GST records automatically (free trial available)

Disclosure: This page may contain an affiliate link. If you sign up, we may earn a commission at no extra cost to you.

What is a Profit Margin?

Profit margin is a key financial metric that measures how much profit your business generates from its revenue. It’s expressed as a percentage and shows the proportion of money left over after accounting for costs. Higher profit margins indicate better financial health and efficiency in converting sales into actual profit.

Understanding Your Calculation Results

Gross Profit

This is your revenue minus cost of goods sold. Using the example: ₹150,000 (Revenue) – ₹10,000 (COGS) = ₹140,000. This shows how much money remains after covering direct production costs.

Gross Margin %

The percentage of revenue that becomes gross profit. In the example: 93.33% means you retain ₹93.33 of every ₹100 in sales after covering COGS. This metric helps evaluate production efficiency.

Net Profit

Your actual profit after all expenses are deducted. Example calculation: ₹150,000 – ₹10,000 – ₹20,000 – ₹0 = ₹120,000. This is the true money available for business growth or owner compensation.

Net Margin %

The percentage of revenue that becomes actual profit. In the example: 80.00% is exceptionally high, meaning ₹80 of every ₹100 in sales becomes profit. Most businesses have much lower net margins.

How to Use the Profit Margin Calculator

Our profit margin calculator is designed for simplicity and speed. Follow these easy steps:

- Enter Revenue (Sales): Input your total sales or revenue amount in your preferred currency (₹ / $ / —)

- Enter Cost of Goods Sold (COGS): Add the direct costs associated with producing your goods or services

- Add Operating Expenses (Opex): Include overhead costs like rent, salaries, utilities, and marketing expenses

- Enter Taxes/Other (Optional): Add tax amounts or other deductions if applicable (e.g., 6000)

- Click Calculate: Get instant results showing:

- Gross Profit: Revenue minus COGS (₹ 140,000.00 in example)

- Gross Margin %: Percentage of revenue retained after COGS (93.33% in example)

- Net Profit: Revenue minus all expenses (₹ 120,000.00 in example)

- Net Margin %: Percentage of revenue retained after all costs (80.00% in example)

- Click Reset: Clear all fields to start a new calculation

Note: The calculator uses the formulas – Gross = Revenue − COGS, Net = Revenue − COGS − Opex − Taxes. Margins are undefined if Revenue is zero.

Why Calculate Profit Margins?

Pricing Strategy Optimization

Understanding your profit margins helps you set competitive prices while maintaining profitability. You can determine the minimum selling price needed to cover costs and achieve desired profit levels.

Business Performance Tracking

Regular profit margin calculations allow you to monitor your business health over time, identify trends, and make data-driven decisions to improve profitability.

Competitive Analysis

Comparing your profit margins with industry benchmarks helps you understand your competitive position and identify areas for improvement.

Investment Decisions

Investors and lenders use profit margins to evaluate business viability and growth potential, making this metric crucial for securing funding.

Understanding Markup vs Margin

Many business owners confuse markup with margin, but they’re different calculations:

Markup is the percentage added to cost to determine selling price: (Selling Price – Cost) / Cost × 100

Margin is the percentage of selling price that is profit: (Selling Price – Cost) / Selling Price × 100

A 50% markup does not equal a 50% margin. Our calculator helps you understand both metrics to make better pricing decisions.

What is a Good Profit Margin?

Good profit margins vary significantly by industry:

- Retail: 2-5% net profit margin is typical

- Restaurants: 3-5% net profit margin is average

- Software/SaaS: 15-25% net profit margin is common

- Healthcare: 5-10% net profit margin is standard

- Construction: 3-7% net profit margin is typical

However, the ideal profit margin for your business depends on factors like industry standards, business model, overhead costs, and growth stage.

Tips to Improve Your Profit Margins

Reduce Operating Costs

Identify unnecessary expenses and streamline operations to lower costs without sacrificing quality. Negotiate better terms with suppliers and optimize inventory management.

Increase Prices Strategically

Evaluate your pricing strategy and consider raising prices where market conditions allow. Focus on communicating value to justify premium pricing.

Improve Operational Efficiency

Automate repetitive tasks, improve workflows, and invest in technology that enhances productivity and reduces labor costs.

Focus on High-Margin Products

Identify and promote products or services with the highest profit margins. Consider discontinuing low-margin offerings that drain resources.

Upsell and Cross-Sell

Increase average transaction value by offering complementary products or premium versions, which often carry higher margins.

Common Profit Margin Mistakes to Avoid

Ignoring Hidden Costs: Many businesses forget to include overhead, shipping, marketing, and administrative costs when calculating margins.

Confusing Revenue with Profit: High revenue doesn’t guarantee profitability. Always focus on margin percentages, not just total sales.

Not Tracking Margins Regularly: Profit margins should be monitored consistently to catch declining profitability early.

Pricing Based on Gut Feeling: Use data-driven calculations rather than intuition when setting prices.

Neglecting Industry Benchmarks: Understanding where you stand compared to competitors helps identify improvement opportunities.

Profit Margin Calculator for Different Business Types

E-commerce Businesses

Calculate margins including shipping costs, payment processing fees, returns, and marketing expenses to get accurate profitability metrics.

Service-Based Businesses

Factor in labor costs, overhead, and time investment to determine service profitability and optimal pricing.

Manufacturing Businesses

Include raw materials, production costs, labor, and operational expenses for comprehensive margin analysis.

Wholesale Businesses

Calculate margins considering bulk pricing, storage costs, and distribution expenses.

Frequently Asked Questions

1. What is a profit margin calculator?

A profit margin calculator helps you quickly determine how much profit you earn from your revenue after deducting COGS, operating expenses, and taxes. It automatically computes Gross Profit, Gross Margin %, Net Profit, and Net Margin % so businesses can make smarter pricing and cost decisions.

2. What is gross profit?

Gross profit is the revenue left after subtracting the Cost of Goods Sold (COGS).

Formula:

Gross Profit = Revenue – COGS

3. What is gross profit margin?

Gross margin percentage shows how efficiently you produce and sell your product before expenses.

Formula:

Gross Margin % = (Gross Profit ÷ Revenue) × 100

4. What is net profit?

Net profit is the amount that remains after deducting COGS, operating expenses (Opex), taxes & other costs from revenue. It’s the real profitability of your business.

5. What is net profit margin?

Net margin percentage shows the total profitability after all expenses.

Formula:

Net Margin % = (Net Profit ÷ Revenue) × 100

6. What is a good profit margin?

Profit margins vary by industry, but generally:

- 5% = low margin

- 10% = average

- 20%+ = high, healthy margin

Tech, SaaS, and digital products often have higher margins compared to retail or manufacturing.

7. What is the difference between gross margin and net margin?

- Gross Margin measures product-level profitability (before expenses).

- Net Margin measures overall business profitability (after all expenses).

Both are essential for pricing and cost analysis.

8. Why should businesses calculate profit margins regularly?

Checking margins helps you:

- Price products correctly

- Control rising costs

- Improve efficiency

- Evaluate business performance

- Plan growth and investments

It’s one of the most important metrics for founders and small businesses.

9. Can this calculator be used for any currency (₹, $, €, etc.)?

Yes. The calculator accepts any currency (₹, $, €, £) because calculations are based on values, not symbols. Just enter numbers according to your currency.

10. What inputs do I need to calculate profit margin?

You only need:

- Revenue (Sales)

- COGS

Optional: - Operating Expenses (Opex)

- Taxes / Other Costs

11. Does the calculator work for both physical and digital businesses?

Yes. It works for:

- Ecommerce & D2C

- Services

- SaaS

- Manufacturing

- Agencies

- Freelancers

Any business model with revenue & costs can use this calculator.

12. Can I calculate profit margin for multiple products?

Yes. Enter values for each product individually to analyze their profitability.

For bulk analysis, you can repeat the calculation or build a spreadsheet using the same formulas.

13. What if my revenue is zero?

If revenue is 0, margin cannot be calculated.

The calculator will show “—” because margin percentage becomes undefined.

Make sure to enter a valid revenue value.

14. Why is my net margin showing negative?

A negative net margin means:

- Expenses are higher than revenue

- Product is not priced correctly

- Costs have increased

- Business is operating at a loss

Use the results to adjust pricing or reduce costs.

15. How accurate are the calculator results?

The calculator uses industry-standard formulas for gross and net margins. Results are accurate for financial analysis, pricing decisions, and planning. However, for complex accounting, consult a financial expert.

Start Calculating Your Profit Margins Today

Whether you’re a startup founder, small business owner, freelancer, or enterprise manager, understanding your profit margins is crucial for sustainable growth. Use our free, mobile-accessible profit margin calculator to gain instant insights into your business profitability.

Get instant clarity on your margins – calculate now and optimize your pricing strategy with confidence!

Simply enter your revenue, costs, and expenses to see your gross profit, net profit, gross margin %, and net margin % in seconds. No registration required, completely free, and accessible on any device.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Personal Loan EMI Calculator

- Home Loan EMi Calculator

- SIP Calculator

- SIP Goal Calculator

- CAGR Calculator

- XIRR Calculator

- SWP Calculator

- STP Calculator

- Free Lumpsum Investment Calculator: Maximize the Future Value

- CSV to JSON Converter

- QR Code Generator

- CSV to Excel Converter

- Base64 Encoder/Decoder

- Regex Tester

- JSON Formatter & Validator

- UUID Generator

- Strong Password Generator

- Lorem Ipsum Generator

- URL Encoder & Decoder

- HTML escape-unescaped tools

- JPG to PDF Converter

- PDF to JPG Converter

- PDF Compressor

- PDF Merge

- Case Converter

- Break-Even Calculator

- ROI Calculator

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM