Free Break-even Calculator: Discover Your Path to Profitability in Seconds

Running a business without knowing your break-even point is like driving blindfolded. You need to know exactly how many sales it takes to cover your costs before you can start making real profit. Whether you’re launching a new product, adjusting prices, or planning for growth, our free break-even calculator gives you instant, accurate answers.

Stop guessing and start knowing. Enter your costs and pricing below to calculate your break-even units, revenue targets, and contribution margins in real-time. Make smarter business decisions backed by solid numbers.

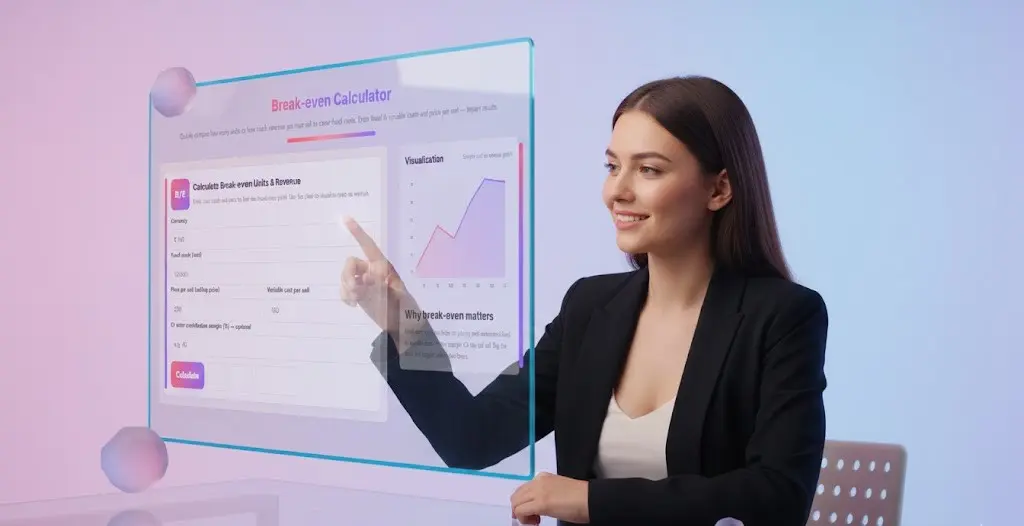

Break-even Calculator

Quickly compute how many units or how much revenue you must sell to cover fixed costs. Enter fixed & variable costs and price per unit — instant results.

Calculate Break-even Units & Revenue

Visualization

Why break-even matters

Break-even analysis helps set pricing and understand fixed vs variable costs. When margin ≤ 0 the tool will flag the issue and suggest corrective levers.

What is Break-even Point? Understanding the Core Concept

The break-even point is the precise moment in your business where total revenue equals total costs. At this critical juncture, you’re neither making a profit nor incurring a loss—you’re simply covering all your expenses. It’s the minimum performance threshold every business must cross to survive.

Think of it as the finish line you must reach before your business starts making actual money. Every sale before the break-even point chips away at your losses. Every sale after the break-even point is pure profit contribution.

The Core Formula Explained

Total Revenue = Total Costs

Or more specifically:

(Price per Unit × Quantity Sold) = Fixed Costs + (Variable Cost per Unit × Quantity Sold)

This fundamental equation is the foundation of all break-even analysis. When you solve for quantity, you discover exactly how many units you need to sell to break even.

The Three Essential Components

1. Fixed Costs – Expenses that remain constant regardless of sales volume. Whether you sell nothing or everything, these costs stay the same. Examples include rent, salaries, insurance, and equipment leases.

2. Variable Costs – Expenses that change in direct proportion to production or sales volume. These include raw materials, packaging, shipping, and sales commissions. More sales mean higher variable costs.

3. Revenue – The income generated from selling your products or services. Revenue equals your selling price multiplied by the number of units sold.

Why the Break-even Point Matters

Understanding your break-even point answers critical business questions:

- Minimum Performance Required: How many sales do you absolutely need to avoid losses?

- Pricing Validation: Is your current pricing strategy viable given your cost structure?

- Risk Assessment: How far are you from break-even, and what’s your margin of safety?

- Profit Planning: Once you know break-even, you can calculate exactly what’s needed for target profits.

- Decision Making: Should you reduce costs, increase prices, or focus on volume?

The break-even point transforms abstract costs and prices into concrete, actionable targets. It’s the difference between running a business on hope versus running it on data.

Break-even in Units vs Revenue

You can express break-even in two ways:

Break-even Units tells you how many products or services you must sell. This is most useful for operations planning, inventory management, and setting sales quotas.

Break-even Revenue tells you the dollar amount of sales needed. This is most useful for financial planning, budgeting, and measuring overall business performance.

Both metrics tell the same story from different angles, and understanding both gives you complete visibility into your profitability threshold.

Why Break-even Analysis is Critical for Your Business Success

Break-even analysis reveals the minimum performance your business needs to avoid losses. It’s one of the most powerful financial tools for entrepreneurs, startups, and established businesses alike.

Understanding this critical threshold helps you set realistic sales targets, optimize pricing strategies, and make confident decisions about scaling operations. Every successful business owner knows their break-even numbers by heart.

What You Get From This Calculator

Our break-even calculator delivers comprehensive insights in seconds:

Contribution Margin Per Unit – See exactly how much each sale contributes toward covering fixed costs and generating profit. This is your per-unit profitability indicator.

Contribution Margin Ratio – Understand what percentage of each sales dollar is available for fixed costs and profit. Higher ratios mean healthier business models.

Break-even Units – Know precisely how many products or services you must sell to cover all expenses. This is your minimum sales target.

Break-even Revenue – Calculate the total sales value needed to reach profitability. Use this for setting monthly and quarterly revenue goals.

Visual Cost vs Revenue Graph – See where your revenue line crosses your total cost line, making the break-even concept crystal clear.

How to Calculate Break-even Point: The Essential Formulas

Understanding the math behind break-even analysis empowers you to make quick mental calculations and understand how different factors affect profitability.

Break-even Units Formula

Break-even Units = Fixed Costs ÷ (Price per Unit – Variable Cost per Unit)

This tells you how many units you need to sell to cover all costs.

Break-even Revenue Formula

Break-even Revenue = Fixed Costs ÷ Contribution Margin Ratio

This shows the total sales dollars needed to break even.

Contribution Margin Calculation

Contribution Margin per Unit = Price per Unit – Variable Cost per Unit

Contribution Margin Ratio = (Price – Variable Cost) ÷ Price × 100

These metrics reveal how efficiently each sale contributes to profitability.

Understanding Fixed Costs vs Variable Costs

Getting these categories right is crucial for accurate break-even analysis.

Fixed Costs (Overhead)

These expenses stay constant regardless of how much you produce or sell:

- Rent and lease payments

- Salaries and fixed wages

- Insurance premiums

- Equipment depreciation

- Software subscriptions

- Utilities (base charges)

- Loan payments

- Marketing retainers

Fixed costs must be paid whether you sell zero units or thousands. They create the baseline expense your business must overcome.

Variable Costs (Per-Unit Costs)

These expenses increase directly with each unit produced or sold:

- Raw materials and components

- Product packaging

- Direct labor (hourly, commission)

- Shipping and freight costs

- Payment processing fees

- Sales commissions

- Cost of goods sold (COGS)

Variable costs only exist when you make a sale, so they scale with your business volume.

Real-World Applications: When to Use Break-even Analysis

Before Launching a New Product

Calculate whether projected sales volumes can achieve profitability within an acceptable timeframe. If break-even requires selling 10,000 units monthly but your market size is only 5,000 potential customers, you’ll know to adjust pricing or reconsider the venture.

Setting or Adjusting Prices

Test different price points to see their impact on break-even units. Sometimes increasing price by 10% can reduce required sales volume by 30%, making profitability much easier to achieve.

Evaluating Cost Reduction Initiatives

Compare the impact of reducing fixed costs (negotiating lower rent) versus variable costs (finding cheaper suppliers). Our calculator shows you which strategy gets you to profitability faster.

Planning Business Expansion

When adding capacity, equipment, or locations, your fixed costs increase. Calculate the new break-even point to understand how much additional sales volume you need to justify the expansion.

Securing Financing or Investment

Investors and lenders want to see that you understand your numbers. Presenting clear break-even analysis demonstrates financial competency and realistic planning.

Performance Monitoring

Track your break-even point monthly or quarterly. A rising break-even point signals increasing inefficiency, while a declining one shows improving business health.

How to Interpret Your Break-even Results

Healthy Contribution Margins

While benchmarks vary by industry, here are general guidelines:

- Above 50%: Excellent—strong pricing power and cost control

- 30-50%: Good—sustainable business model with profit potential

- 15-30%: Moderate—requires high volume to be profitable

- Below 15%: Concerning—vulnerable to cost increases and price competition

- Negative: Critical—losing money on every sale

Realistic Break-even Units

Compare your break-even units against:

- Market Size: Can your target market support this volume?

- Production Capacity: Can you actually produce this many units?

- Sales Capacity: Can your team realistically sell this volume?

- Time Constraints: How long will it take to reach this sales level?

If your break-even point exceeds realistic market or operational capabilities, you need to adjust costs or pricing.

Strategies to Lower Your Break-even Point

Reduce Fixed Costs

- Negotiate better lease terms or consider co-working spaces

- Optimize staffing levels and compensation structures

- Switch from owned to leased equipment

- Outsource non-core functions

- Use digital tools to reduce administrative overhead

- Share resources with complementary businesses

Decrease Variable Costs

- Negotiate bulk purchasing discounts with suppliers

- Improve production efficiency and reduce waste

- Optimize shipping and logistics

- Automate repetitive processes

- Implement quality control to reduce defects and returns

- Find alternative suppliers without sacrificing quality

Increase Unit Price

- Add value through better features, service, or experience

- Improve brand positioning and perceived value

- Target less price-sensitive customer segments

- Bundle products for higher average transaction value

- Test price increases—demand is often less elastic than expected

- Create premium versions of existing products

Improve Product Mix

- Emphasize high-margin products in marketing and sales

- Phase out low-margin offerings that require high volume

- Cross-sell and upsell to increase average order value

- Develop complementary products with better margins

- Focus on repeat customers who cost less to serve

Common Break-even Analysis Mistakes to Avoid

Incomplete Cost Accounting: Many businesses forget to include indirect costs like credit card processing fees, returns and refunds, warranty expenses, quality control, and administrative overhead. Include everything.

Miscategorizing Costs: Some costs are semi-variable (like utilities that have both fixed and usage components). Split these appropriately or you’ll get inaccurate results.

Ignoring Market Reality: A low break-even point means nothing if market demand can’t support the required volume. Always validate break-even assumptions against real market conditions.

One-Time Analysis: Your break-even point changes constantly as costs fluctuate, competitors adjust pricing, and operations evolve. Recalculate at least quarterly.

Overlooking Capacity Constraints: Reaching your break-even sales volume is impossible if you lack the production capacity, staff, or time to deliver.

Negative Contribution Margin: If variable costs exceed your selling price, you lose money on every sale. No amount of volume can save you—fix pricing or costs immediately.

Industry-Specific Break-even Considerations

Retail and E-commerce

Factor in inventory carrying costs, shrinkage from theft or damage, seasonal demand fluctuations, returns and refunds (often 20-30% for online retail), and marketplace or platform fees.

Service Businesses

Labor represents the primary variable cost. Consider utilization rates (billable vs non-billable hours), service delivery capacity constraints, and client acquisition costs relative to lifetime value.

Manufacturing

Include equipment maintenance, utilities that scale with production, quality control and testing costs, and raw material price volatility. Economies of scale can dramatically improve margins at higher volumes.

SaaS and Subscription Models

Customer acquisition cost (CAC) should be weighed against lifetime value (LTV). Include server and hosting costs that scale with users, customer support overhead, and churn rates that affect long-term revenue.

Restaurants and Food Service

Account for food waste (typically 4-10% of food costs), fluctuating commodity prices, menu mix variations (different items have different margins), and labor costs that can be semi-variable.

Professional Services

Consider professional development costs, licensing and certification fees, professional liability insurance, and the opportunity cost of non-billable administrative time.

Beyond Break-even: Planning for Profit Targets

Knowing your break-even point is essential, but planning for actual profit is where business success happens.

Target Profit Calculation

Required Units = (Fixed Costs + Target Profit) ÷ Contribution Margin per Unit

Example: If your fixed costs are ₹120,000, you want ₹50,000 profit, and your contribution margin is ₹100 per unit: Required Units = (₹120,000 + ₹50,000) ÷ ₹100 = 1,700 units

This means you need to sell 700 units beyond your 1,200 break-even point to achieve your profit goal.

Safety Margin Analysis

Margin of Safety = (Current Sales – Break-even Sales) ÷ Current Sales × 100

This shows how much sales can drop before you start losing money. A higher margin of safety means lower business risk.

Break-even Calculator — Frequently Asked Questions (FAQ)

1. What is a break-even point?

The break-even point is the level of sales (units or revenue) at which your total costs are fully covered. At this point, profit is zero — you are neither making a loss nor a gain. Any sales beyond this point generate profit.

2. How do you calculate the break-even point?

The standard formula is:

Break-even units = Fixed Costs ÷ Contribution per Unit

where

Contribution per Unit = Selling Price − Variable Cost per Unit

You can also calculate break-even revenue by multiplying break-even units by selling price.

3. What is the contribution margin?

The contribution margin represents how much each unit contributes toward covering fixed costs and generating profit.

Formula:

Contribution Margin per Unit = Selling Price − Variable Cost

Contribution Margin Ratio = Contribution Margin ÷ Selling Price

A higher margin helps you break even faster.

4. What’s the difference between fixed and variable costs?

- Fixed costs: Costs that do not change with sales volume (rent, salaries, insurance).

- Variable costs: Costs that change with production or sales (materials, packaging, commissions).

The calculator uses both to compute your break-even point accurately.

5. What does a negative or zero contribution margin mean?

If contribution margin ≤ 0, you cannot break even because you lose money on every unit.

To fix this, you must:

✓ Increase selling price

✓ Reduce variable cost

✓ Reduce discounts / promotions

6. Why do break-even units always round up?

Units represent physical items — you cannot sell half a unit.

Even if the formula gives 122.4 units, you must sell 123 units to cover your costs.

7. Can I calculate break-even revenue instead of units?

Yes. Break-even revenue is:

Break-even Revenue = Break-even Units × Selling Price

The calculator shows both automatically.

8. What industries use break-even analysis?

Break-even analysis is widely used in:

- Manufacturing

- Retail & eCommerce

- Restaurants & cafés

- Freelancing / services

- SaaS and digital products

- Startups doing pricing or forecasting

It’s essential for planning, budgeting, and pricing decisions.

9. How accurate is the break-even calculator?

The calculator is highly accurate for:

- Single product pricing

- Unit-based businesses

- Revenue forecasting

- Basic cost analysis

For more complex models (multi-product, changing cost structure, dynamic pricing), advanced financial modeling is required (we can build tools for that too).

10. Can this calculator help with pricing decisions?

Yes. Break-even analysis helps you understand:

- Minimum units required to avoid losses

- Impact of price increase or discount

- Whether your business model is profitable

- How cost reduction affects profitability

It’s a powerful decision-making tool for business owners.

11. What if I enter a contribution margin percentage instead of costs?

Our calculator supports both:

- Traditional cost-based input

- Direct contribution margin (%)

If you enter a percentage, the contribution per unit is calculated automatically.

12. Does the tool work on mobile?

Yes — the Toolsuite Break-even Calculator is fully responsive and works on:

- Mobile

- Tablet

- Desktop

- All modern browsers

Take Control of Your Business Finances Today

Understanding your break-even point transforms how you run your business. Instead of hoping for profitability, you’ll have concrete targets and actionable insights. Use our calculator above to get instant clarity on exactly what your business needs to succeed.

Input your numbers, analyze the results, and make data-driven decisions that drive real profitability. Whether you’re validating a business idea, optimizing operations, or planning growth, break-even analysis is your financial compass.

Start calculating now and discover your path to profitability.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Personal Loan EMI Calculator

- Home Loan EMi Calculator

- SIP Calculator

- SIP Goal Calculator

- CAGR Calculator

- XIRR Calculator

- SWP Calculator

- STP Calculator

- Free Lumpsum Investment Calculator: Maximize the Future Value

- CSV to JSON Converter

- QR Code Generator

- CSV to Excel Converter

- Base64 Encoder/Decoder

- Regex Tester

- JSON Formatter & Validator

- UUID Generator

- Strong Password Generator

- Lorem Ipsum Generator

- URL Encoder & Decoder

- HTML escape-unescaped tools

- JPG to PDF Converter

- PDF to JPG Converter

- PDF Compressor

- PDF Merge

- Case Converter

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM