Smart Withdrawal Planning Starts Here: Try Our SWP Calculator India

A Systematic Withdrawal Plan (SWP) is one of the safest and most flexible ways to create a monthly income from your mutual fund investments—without liquidating your entire portfolio. Use our free SWP Calculator to estimate your monthly withdrawal amount, fund longevity, returns generated, and balance value over time.

This simple tool helps you plan tax-efficient cash flow, compare withdrawal strategies, and understand how long your investments can sustain your lifestyle.

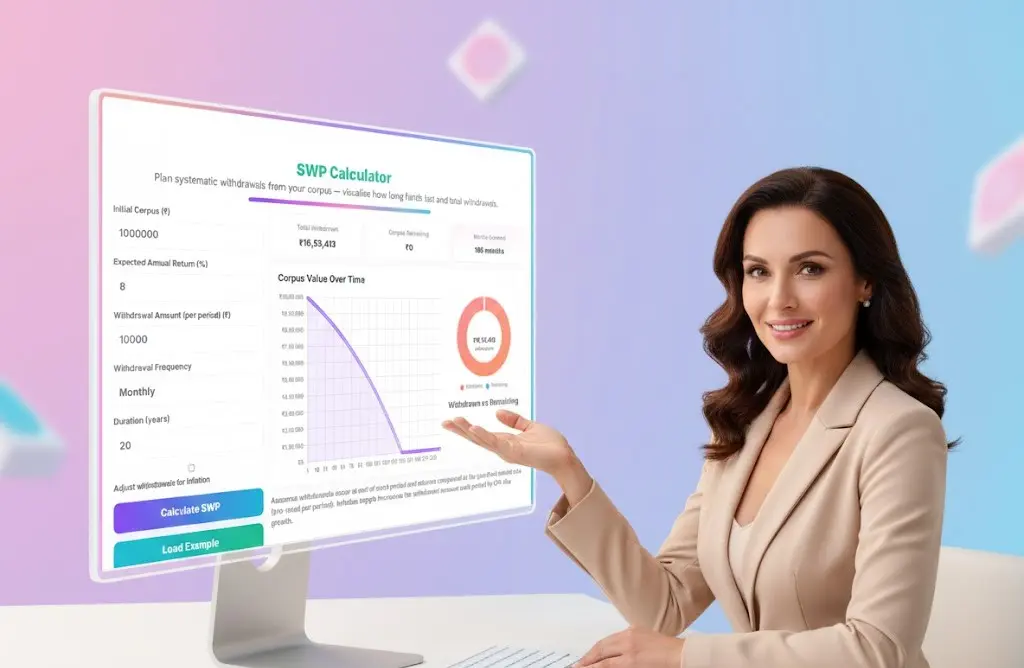

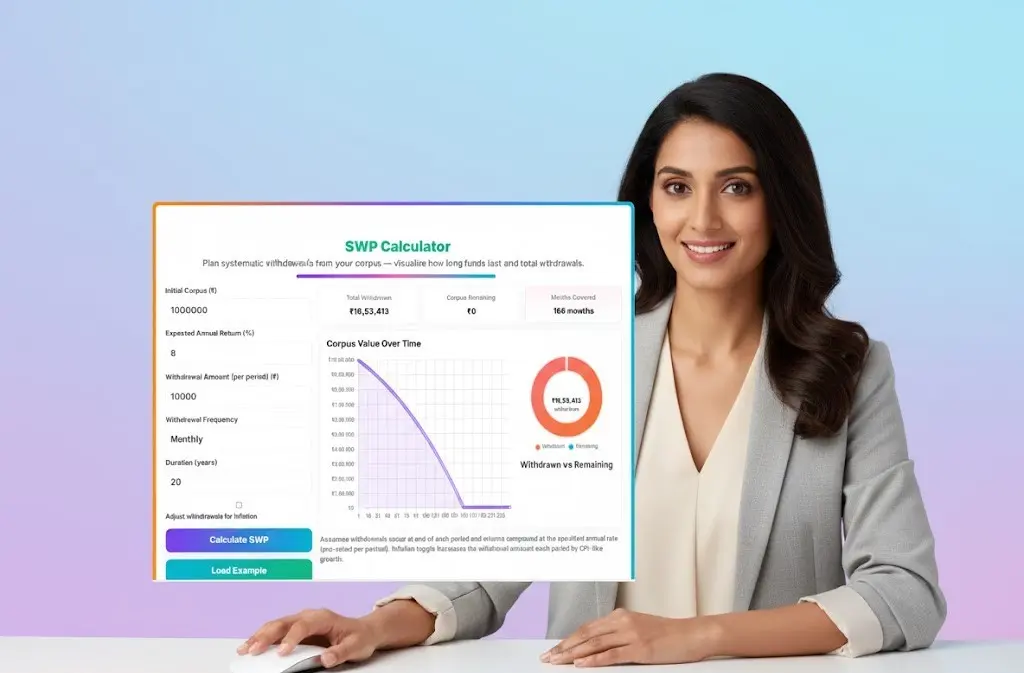

SWP Calculator

Plan systematic withdrawals from your corpus — visualise how long funds last and total withdrawals.

Tip: Toggle inflation to simulate rising withdrawals. Use monthly frequency for common SWP schedules.

Corpus Value Over Time

What Is an SWP (Systematic Withdrawal Plan)?

An SWP – Systematic Withdrawal Plan allows an investor to withdraw a fixed amount from their mutual fund investment at regular intervals—usually monthly. Unlike selling the entire investment at once, SWP offers stability, controlled withdrawals, and the flexibility to generate a secondary income.

It is widely used by:

- Retirees for monthly income

- Investors who want controlled redemptions

- Individuals planning tax-efficient withdrawals

- Anyone looking to convert a lumpsum into regular cash flow

SWP ensures that your money continues growing through market returns even as you systematically withdraw from it.

Benefits of Using an SWP Calculator

Our SWP Calculator India helps you:

✅ Plan Monthly Income Confidently

See if your investment can sustain fixed withdrawals for the number of years you want.

✅ Understand Fund Growth vs. Withdrawals

Learn how much of your corpus is being withdrawn vs. how much continues compounding.

✅ Estimate Remaining Balance

Visual charts help you understand how long your portfolio will last at your chosen withdrawal rate.

✅ Choose Smart Withdrawal Strategy

Test different scenarios instantly:

- Increase monthly withdrawal

- Reduce or increase expected return

- Choose longer or shorter time horizon

This gives you a strategic view of your financial future.

⭐ How to Use the SWP Calculator (Step-by-Step Guide)

Follow these simple steps to get accurate SWP projections:

Step 1: Enter Your Investment Amount (Lumpsum)

This is the total amount you have invested in the mutual fund scheme.

Step 2: Enter Your Expected Return Rate (%)

This is the assumed annual return of your investment.

Example: Equity funds ≈ 10–12%, Debt funds ≈ 6–8%.

Step 3: Enter Monthly Withdrawal Amount

This is the amount you plan to withdraw every month.

Step 4: Enter Time Duration (Years)

This tells the calculator how long the SWP should run.

Step 5: Click “Calculate”

The tool instantly displays:

- Total withdrawn amount

- Interest earned

- Final portfolio value

- Year-wise or month-wise chart

- Balance graph showing sustainability

This helps you optimize your withdrawal strategy for long-term financial health.

⭐ Where Is SWP Useful?

SWP is ideal for:

✔ Retirement planning

✔ Monthly income without touching capital

✔ Tax-efficient withdrawals

✔ Volatility protection compared to lump-sum redemptions

✔ Passive income stream for salaried or self-employed persons

Unlike regular withdrawals, SWP offers higher longevity, less tax, and continuous growth.

⭐ Important Notes

- SWP does not guarantee returns; fund performance depends on markets.

- High withdrawals may deplete the balance sooner.

- Always evaluate multiple scenarios using the calculator before deciding.

- For SIP users looking for withdrawal planning, combining SIP + SWP strategy works well.

Frequently Asked Questions (FAQ) — SWP Calculator India

Q1. What is an SWP and how does a Systematic Withdrawal Plan work?

A Systematic Withdrawal Plan (SWP) allows investors to withdraw a fixed amount from their mutual fund investment at regular intervals—usually monthly. Your remaining balance continues to grow through compounding returns. Using an SWP Calculator India, you can estimate how long your corpus will last, how much interest you’ll earn, and what your final fund value will be after all planned withdrawals. This makes SWP ideal for generating predictable monthly income with market-linked growth.

Q2. How does the SWP Calculator help in retirement planning?

The SWP Calculator is especially useful for retirement income planning because it shows whether your current investment is enough to sustain long-term withdrawals. Retirees often rely on SWP to receive a stable monthly income without redeeming their mutual fund investment all at once. The calculator also highlights key parameters such as expected return, monthly withdrawal amount, SWP duration, and remaining balance, helping retirees plan a stress-free cash flow strategy.

Q3. Can I lose money in an SWP?

Yes, you can—but only if your monthly withdrawal amount is too high or your mutual fund performs poorly. If you withdraw more than your fund generates through market returns, your corpus may deplete faster. The Systematic Withdrawal Plan Calculator helps you avoid this by showing the sustainability of your withdrawal rate using charts, projections, and balance estimates. This allows you to fine-tune your SWP amount for long-term financial stability.

Q4. Is SWP better than FD or dividend plans for monthly income?

For many investors, SWP is better than Fixed Deposits (FDs) or mutual fund dividend options because:

- It offers potentially higher returns

- Withdrawals may be more tax-efficient due to capital gains rules

- You can fully customize your withdrawal amount

- Your principal continues to grow in equity or hybrid funds

FDs provide guaranteed returns but low yield, and mutual fund dividends are irregular. SWPs combine flexibility, stability, and long-term growth, making them one of the best monthly income tools for investors.

Q5. How do taxes work on SWP withdrawals?

SWP withdrawals are taxed based on capital gains, not as regular income.

- Equity funds:

- Held < 1 year → Short-term capital gains at 15%

- Held > 1 year → Long-term gains taxed at 10% above ₹1 lakh

- Debt funds (post-April 2023) are taxed based on slab rates

The SWP Calculator helps you simulate how long your investment lasts but does not apply taxation automatically—however, your chart outputs help in estimating potential capital gains impact.

Q6. How much should I withdraw monthly using SWP?

A safe SWP withdrawal rate generally ranges between 6% to 8% annually for equity-oriented funds and 4% to 6% for debt funds. Your ideal amount depends on your investment duration, risk tolerance, and financial goals. Use the Mutual Fund SWP Return Calculator to run multiple scenarios and identify a sustainable withdrawal rate that doesn’t deplete your investment prematurely.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Simple EMI Calculator

- Advance Term Loan EMI Calculator

- Car Loan EMI Calculator

- Personal Loan EMI Calculator

- Home Loan EMi Calculator

- SIP Calculator

- SIP Goal Calculator

- CAGR Calculator

- XIRR Calculator

- Free Lumpsum Investment Calculator: Maximize the Future Value

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM