EMI Term Loan Calculator – Calculate Your Monthly Loan Payments Instantly

Planning to take a term loan? Our advanced EMI term loan calculator helps you determine your exact monthly installment (EMI) before you commit to any loan. Whether you’re considering a home loan, personal loan, or business loan, understanding your EMI is crucial for financial planning.

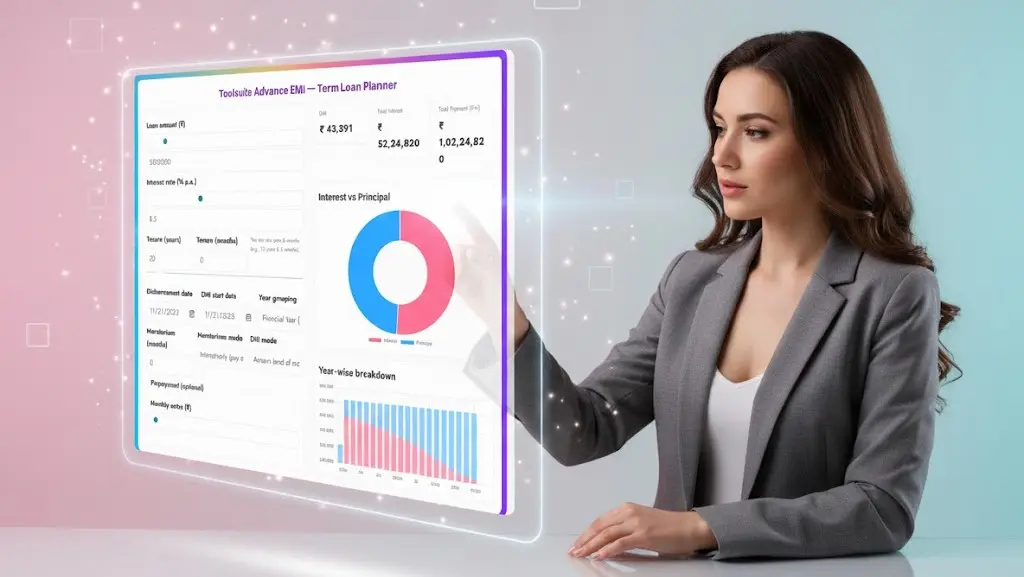

Toolsuite Advance EMI — Term Loan Planner

This tool is for education only; bank EMI may vary due to rounding, reset cycles, and charges.

Interest vs Principal

Year-wise breakdown

Loan details

Amortization schedule

| # | Date | Opening | Payment | Interest | Principal | Prepay | Closing |

|---|

Values rounded to the nearest rupee; final installment adjusts for rounding.

What is an EMI Calculator?

An EMI (Equated Monthly Installment) calculator is a financial tool that helps you calculate the monthly payment you’ll need to make toward your loan. Our term loan planner provides comprehensive details including:

- Monthly EMI amount

- Total interest payable over the loan tenure

- Total payment amount (Principal + Interest)

- Year-wise payment breakdown

- Principal vs. interest distribution

How to Use Our Term Loan EMI Calculator

Using our loan EMI planner is simple and straightforward:

- Enter Loan Amount: Input the principal amount you wish to borrow (in ₹)

- Set Interest Rate: Add the annual interest rate (in percentage)

- Choose Tenure: Select your loan duration in years and months

- Configure Dates: Set your disbursement date and EMI start date

- Select Moratorium: Choose if you need a moratorium period

- Select Prepayment or monthly extra: Choose if you plan to prepay or monthly extra

- View Results: Instantly see your EMI, total interest, and payment breakdown

Understanding Your Loan Calculation Results

EMI Breakdown

Our calculator provides a visual representation of your loan structure through an interactive pie chart showing:

- Principal Amount: The actual loan amount you’re borrowing

- Interest Component: The total interest you’ll pay over the loan tenure

- Total Payment: Combined amount of principal and interest

Year-wise Amortization Schedule

Get a detailed year-wise breakdown of your loan repayment showing:

- How much principal you’ll pay each year

- Interest component for each financial year

- Outstanding balance at the end of each year

Key Features of Our Advanced EMI Calculator

Flexible Tenure Options

Calculate EMI for any loan tenure by combining years and months. Whether you need a short-term loan of 2 years or a long-term home loan of 30 years, our calculator handles it all.

Moratorium Period Support

Planning for a grace period? Our calculator allows you to factor in moratorium periods where you may pay only interest or defer payments entirely.

Multiple EMI Modes

Choose between different EMI structures:

- Standard EMI (equal monthly payments)

- Pre-EMI options

- Advance EMI calculations

Financial Year Grouping

View your payment schedule aligned with the financial year (April to March) for better tax planning and documentation.

Benefits of Using an EMI Calculator Before Taking a Loan

Better Financial Planning

Understanding your monthly loan obligation helps you assess whether the EMI fits comfortably within your monthly budget without straining your finances.

Compare Loan Offers

Use our calculator to compare different loan offers by adjusting interest rates and tenures to find the most affordable option.

Understand Interest Impact

See exactly how much interest you’ll pay over the loan tenure. Even a small difference in interest rates can significantly impact your total payment.

Plan Prepayments

By understanding your amortization schedule, you can identify optimal times for making prepayments to reduce your overall interest burden.

Avoid Surprises

Know your exact financial commitment upfront. No hidden calculations or surprise amounts later.

How EMI is Calculated: The Formula

The EMI calculation uses the following formula:

EMI = [P × R × (1+R)^N] / [(1+R)^N-1]

Where:

- P = Principal loan amount

- R = Monthly interest rate (Annual rate ÷ 12 ÷ 100)

- N = Loan tenure in months

Our calculator automates this complex calculation, giving you instant results without manual computation.

Tips for Managing Your Term Loan EMI

Choose the Right Tenure

Longer tenures mean lower EMIs but higher total interest. Shorter tenures increase EMI but reduce interest costs. Find the balance that works for your budget.

Maintain a Good Credit Score

A better credit score can help you negotiate lower interest rates, reducing your EMI and total interest payable.

Consider Making Prepayments

Even small prepayments can significantly reduce your loan tenure and interest burden. Use our calculator to see the impact of prepayments.

Keep EMI Below 40% of Income

Financial experts recommend keeping your total EMI obligations below 40% of your monthly income for comfortable repayment.

Review Before Borrowing

Always calculate and understand your EMI before signing loan documents. Use our tool to ensure the terms match your capacity.

Common Loan Types You Can Calculate

Our term loan calculator works for various loan types:

- Home Loans: Calculate EMI for property purchases with tenures up to 30 years

- Personal Loans: Plan unsecured loans for personal needs

- Car Loans: Determine auto loan payments with typical 3-7 year tenures

- Business Loans: Calculate working capital or expansion loan EMIs

- Education Loans: Plan student loan repayments with moratorium periods

- Loan Against Property: Calculate secured loan EMIs at competitive rates

Factors Affecting Your Loan EMI

Interest Rate

The most significant factor. Even a 0.5% difference can mean thousands of rupees over the loan tenure.

Loan Amount

Higher principal means higher EMI. Borrow only what you need and can comfortably repay.

Loan Tenure

Directly impacts EMI amount. Longer tenure = lower EMI but more total interest.

Processing Fees

While not part of EMI, remember to account for upfront costs like processing fees and documentation charges.

Prepayment Charges

Some lenders charge penalties for early repayment. Factor this if you plan to prepay.

Why Choose Our Toolsuite Advance EMI Calculator?

100% Accurate Calculations

Our calculator uses standard financial formulas ensuring accuracy for your loan planning.

User-Friendly Interface

Clean, intuitive design makes loan calculation easy even for first-time borrowers.

Detailed Breakdowns

Get comprehensive payment schedules, not just a simple EMI number.

Visual Representations

Interactive charts help you understand principal vs. interest distribution at a glance.

No Registration Required

Use our calculator instantly without creating accounts or providing personal information.

Mobile-Friendly

Calculate EMI on any device – desktop, tablet, or smartphone.

Always Free

Professional-grade loan calculation tool available at no cost.

Understanding Moratorium and EMI Modes

What is a Moratorium Period?

A moratorium is a grace period where you don’t pay EMI or pay only the interest component. This is common in education loans and construction-linked home loans.

Moratorium Mode Options

- Full Moratorium: No payments during the grace period

- Partial Moratorium: Interest-only payments

- EMI Mode: Regular equal monthly installments from day one

Making Informed Borrowing Decisions

Before applying for any term loan, use our calculator to:

- Determine Affordability: Ensure the EMI fits your budget

- Compare Options: Evaluate different interest rates and tenures

- Plan Finances: Understand long-term financial commitments

- Optimize Tenure: Find the right balance between EMI and total interest

- Budget Accurately: Account for loan repayment in monthly expenses

Start Planning Your Loan Today

Don’t let loan calculations intimidate you. Our EMI term loan planner simplifies complex financial mathematics into clear, actionable information. Whether you’re planning to buy your dream home, finance your child’s education, or expand your business, understanding your EMI is the first step toward responsible borrowing.

Calculate your loan EMI now and make informed financial decisions with confidence. Adjust the loan amount, interest rate, and tenure to find the perfect loan structure for your needs.

Frequently Asked Questions (FAQ)

1. What is EMI in a term loan?

An EMI (Equated Monthly Instalment) is the fixed monthly amount you repay toward your loan. Each EMI includes two parts:

- Principal – the loan amount you actually borrowed

- Interest – the cost charged by the lender

The EMI remains constant, ensuring the loan is fully repaid by the end of the tenure.

2. How is EMI calculated for term loans?

Banks use the standard EMI formula:

EMI = [P × R × (1 + R)^N] / [(1 + R)^N – 1]

Where:

- P = Principal

- R = Monthly interest rate (Annual Rate ÷ 12 ÷ 100)

- N = Loan tenure in months

Our EMI calculator performs this calculation instantly, eliminating manual work.

3. Can I reduce my EMI amount?

Yes. You can lower your EMI in three ways:

- Increase the tenure — EMI reduces but total interest increases.

- Negotiate a lower interest rate — reduces both EMI and total interest.

- Make a larger down payment or prepayment — reduces your outstanding loan amount, lowering EMI.

4. What is the difference between principal and interest in EMI?

- Principal is the actual loan amount you borrowed.

- Interest is the cost of borrowing.

At the start of your loan, EMIs contain more interest. As the loan matures, the principal portion increases — this shift is called amortization.

5. Should I choose a longer or shorter loan tenure?

It depends on your financial comfort:

- Shorter tenure → Higher EMI but lower overall interest.

- Longer tenure → Lower EMI but higher total interest.

Use the calculator to compare both scenarios and choose the best fit for your budget.

6. What is a good EMI-to-income ratio?

Financial planners recommend keeping total EMIs below 40–50% of your monthly income.

This ensures you have enough room for expenses, savings, and emergencies.

7. Can I prepay my term loan to reduce interest?

Yes. Prepaying reduces your outstanding principal, helping you:

- Save on interest

- Shorten the loan tenure

- Close the loan earlier

Always check your lender’s prepayment charges, especially for fixed-rate loans.

8. What is a moratorium period in term loans?

A moratorium is a temporary break from EMI payments at the beginning of your loan. During this period, you may:

- Pay no EMIs, or

- Pay interest-only EMIs

It is commonly offered for education loans, home construction loans, and certain business loans.

9. How does the interest rate affect my monthly EMI?

Interest rate has a major impact.

For example, on a ₹50 lakh loan over 20 years:

- A 1% increase in rate can raise your EMI by several thousand per month

- And add lakhs of rupees to your total interest paid

Use the calculator to test different interest scenarios.

10. Is EMI calculation the same for all types of loans?

The core EMI formula is the same, but certain loans have variations:

- Pre-EMI for construction-linked home loans

- Step-up EMI where EMI increases over time

- Balloon repayment for commercial loans

Our calculator works for standard term loans with fixed EMIs.

11. Can loan tenure be changed after taking the loan?

Yes. Many banks allow loan restructuring, meaning you can extend or reduce tenure.

This directly affects your EMI amount.

However, banks may apply charges or require re-evaluation of creditworthiness.

12. What happens if I miss an EMI payment?

Missing EMIs can lead to:

- Late payment charges

- Negative impact on your credit score

- Possible legal notices if defaults continue

If you’re facing difficulty, speak to your lender early — restructuring may be an option.

Related Tools and Directory

- Income Tax Calculator

- Tools Directory Overview

- Free Online tools Hub

- Finance & Tax Tools Hub

- Advance Tax Interest Calculator

- GST Calculator

- HRA Exemption Calculator

- TDS Deduction Estimator — Salary (Monthly Estimate)

- Income Tax Slab Comparison

- Gratuity Calculator

- EPF Contribution Calculator

- Explore more tools for Finance & Tax and SEO on TaxBizmantra.com & CAMSROY.COM

Ready to calculate your loan EMI? Use our advance term loan calculator now and take the first step toward informed borrowing. Get instant results with detailed breakdowns and visual representations to help you understand exactly what you’ll pay over your loan tenure.